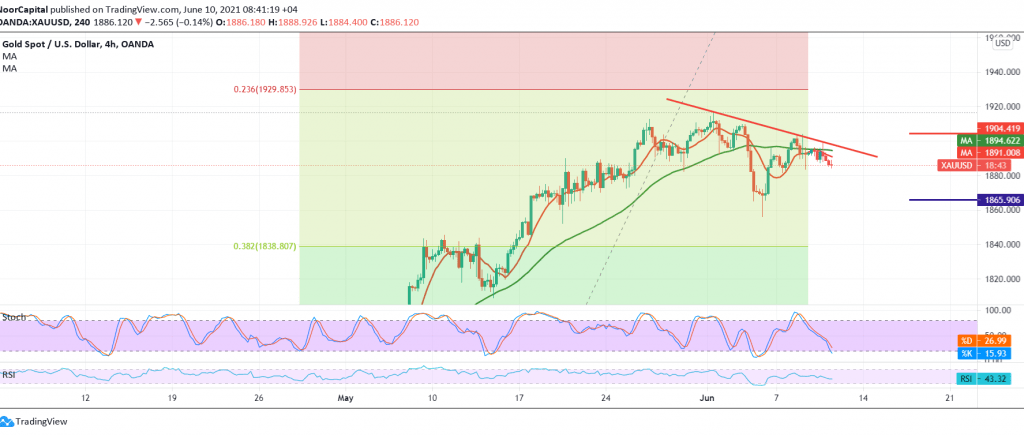

Gold prices opened the morning session with a noticeable bearishness, after hitting the resistance level 1903/1905 within a bearish slope approaching retesting the main support 1880.

On the technical side today, and by looking at the 240-minute chart, we find the 50-day moving average that continues to pressure the price from above, and this comes in conjunction with the negative signals coming from the RSI on the short time frames.

We tend to be negative, but we prefer confirming the breach of the aforementioned support in 1880, and that will facilitate the task required to visit 1874 first target, and then 1865 next official stations.

The return of the stability of trading again above 1895 increases the possibility of witnessing a retest of 1905. Note: the main trend keys today are 1880-1905.

| S1: 1879.00 | R1: 1895.00 |

| S2: 1874.00 | R2: 1905.00 |

| S3: 1864.00 | R3: 1910.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations