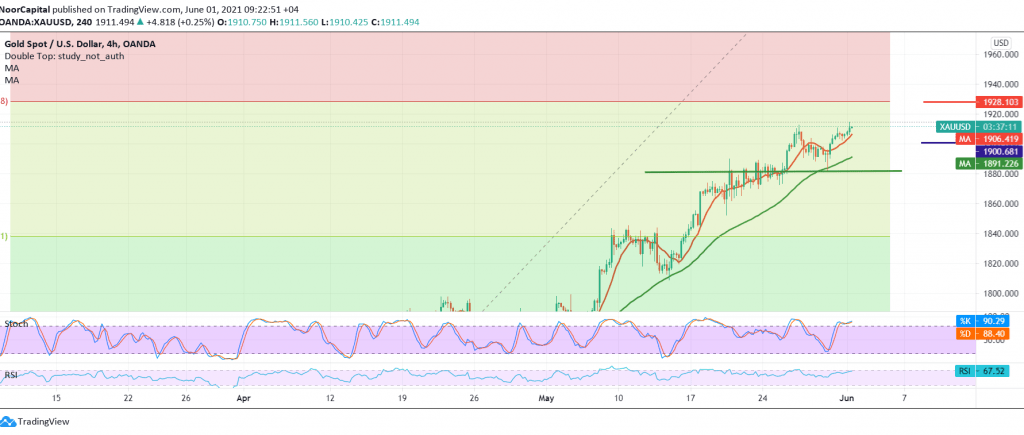

Gold prices managed to maintain their gains within the gradual upward path, touching the first target that is required to be achieved, located at the price of 1912, recording its highest level during the early trading of the current session 1912.

On the technical side today, and by looking at the 240-minute chart, we find the price is stable above the psychological barrier of 1900 accompanied by the positive motive for the 50-day moving average, which meets around the 1890 level and adds more strength to it.

On the other hand, we find negative signs appearing on Stochastic, accompanied by clear warning signs on the RSI indicator.

Although we tend to be positive, but we prefer staying neutral for the moment, in order to maintain the profitability rates that were achieved yesterday, and until the trend becomes clearer more accurately, to be in front of one of the following scenarios:

Continuing to activate the buying positions requires stability above the daily above 1890/1890, as we need to witness the breach of 1912 to facilitate the task required to visit 1916 and after that 1921 an initial official station that may extend its objectives later towards 1926.

Activating short positions is confirmed by breaking 1900, and from here we witness a bearish slope whose initial target is 1892 and may extend to 1887. Warning: The risk level is high.

| S1: 1904.00 | R1: 1916.00 |

| S2: 1897.00 | R2: 1921.00 |

| S3: 1892.00 | R3: 1928.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations