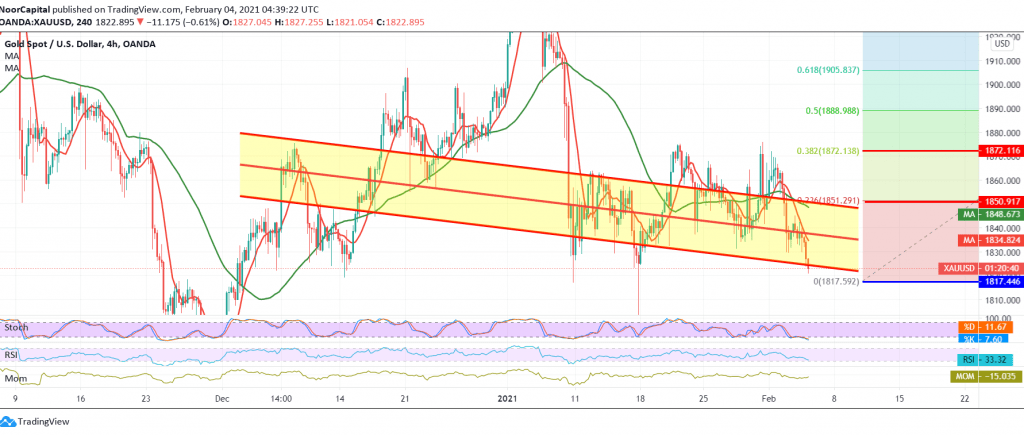

Gold prices continue to gradually crawl to the downside within the expected bearish path, in which we relied on confirming the breach of the 1851 level, approaching our third awaited target of 1817, to record its lowest price during early trading for the current session 1822.

On the technical side, today, with the continuation of the negative pressure coming from the 50-day moving average, which meets around the resistance level of 1837 and adds more strength, in addition to the continued defence of the RSI indicator on the downside. From here, we will maintain our negative outlook, continuing towards 1817 following official stations, and we must monitor price behavior in case the required level is touched, because breaking it forces the price to continue declining towards 1806 and 1800 official targets, respectively.

From the top, the return of trading to stability once again above 1851, the previously broken support and converted to the 23.60% correction resistance level, delays the chances of a reversal, and we may witness an upside corrective path targeting 1871.

In general, we will continue favouring the downside, unless we witness any trading above 1871, a 38.20% retracement.

| S1: 1814.00 | R1: 1837.00 |

| S2: 1806.00 | R2: 1851.00 |

| S3: 1790.00 | R3: 1860.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations