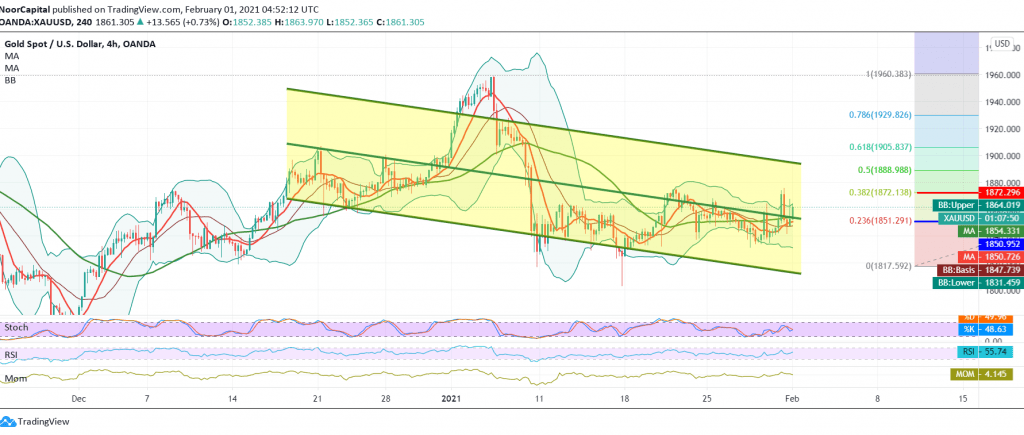

The yellow metal prices started their first weekly trading on a slight upward bias, benefiting from building on the ground of the support 1851, which is near its highest level during the early trading of the current session around 1861.

On the technical side, today the 50 day moving average is providing a positive catalyst, accompanied by positive signs coming from the RSI.

On the other hand, we find negative crossover signs that started appearing on the stochastic, coinciding with trading in general below 1871.

We tend to be negative in our trading, with the price remaining below 1872, Fibonacci retracement of 38.20%, bearing in mind that confirming the breach of 1851, a correction of 23.60%, facilitates the task required to visit 1838 and then 1828 a next official stop.

Trading again above 1872 negates the implementation of the bearish scenario completely, and we may witness positive trades with the first target to re-test 1878.

| S1: 1849.00 | R1: 1870.00 |

| S2: 1838.00 | R2: 1878.00 |

| S3: 1829.00 | R3: 1890.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations