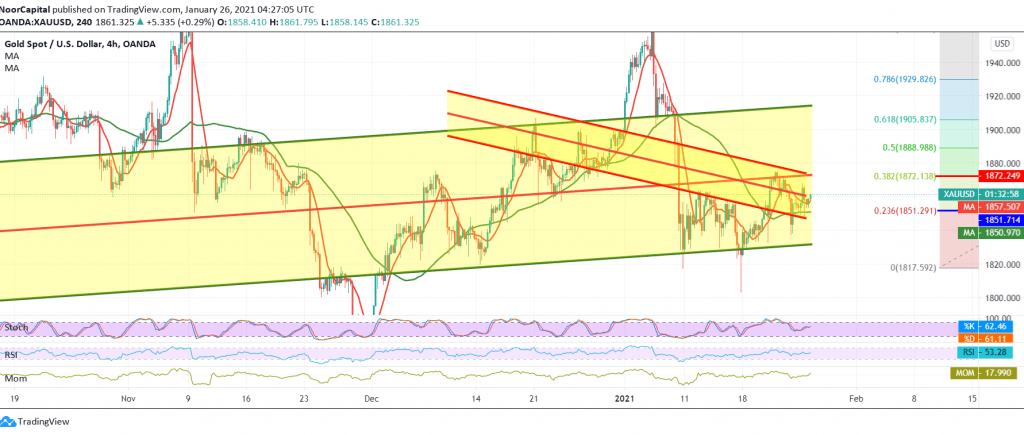

Negative trading dominated the yellow metal yesterday after it found a strong resistance near 1865, which forced it to re-test the 1838 support level.

On the technical side, today we find the RSI trying to provide bullish signs of a rebound on short time frames, supported by the continued obtaining of a positive motive from the 5-day moving average, which is still holding the price from below, and this contradicts with the stochastic losing bullish momentum.

With the conflict of technical signals, in addition to the decline in trading from the bottom above 1838 and from the top below 1865, we will stand on the fence for the second consecutive session in order to obtain a high quality deal, so we are facing one of the following scenarios:

Activating short positions requires that we witness a clear breakout and stabilize the price below 1851, Fibonacci retracement, 23.60%, targeting 1847 and 1838 in succession.

The activation of long positions depends on confirming the breach of 1865, and this is a catalyst that enhances the chances of a rally towards 1872, a correction of 38.20%, a first target, and then 1878 a next stop.

| S1: 1847.00 | R1: 1870.00 |

| S2: 1838.00 | R2: 1878.00 |

| S3: 1829.00 | R3: 1889.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations