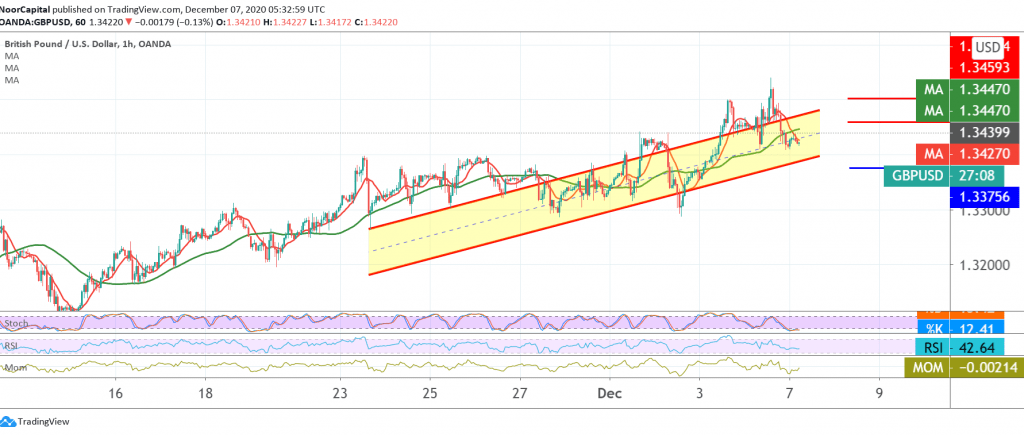

Positive trading dominated the movements of the pound against the US dollar, touching the weekly target at 1.3500, reaching a high of 1.3540.

Technically, the pair failed to stabilize for a long time above the psychological barrier resistance 1.3500, which forced it to trade near the support level 1.3420, so that Stochastic began to gradually lose the bullish momentum.

We tend to be negative in our trading in the coming hours, targeting 1.3375 as a first target, and confirming its breach will extend the pair’s losses, so we will be waiting for 1.3325 before resuming the rise again.

on the upside, rising above 1.3460 is able to abort expected bearish bias, and the pair will recover again, with initial targets starting at 1.3500 and later extending towards 1.3580.

| S1: 1.3375 | R1: 1.3505 |

| S2: 1.3325 | R2: 1.3580 |

| S3: 1.3245 | R3: 1.3635 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations