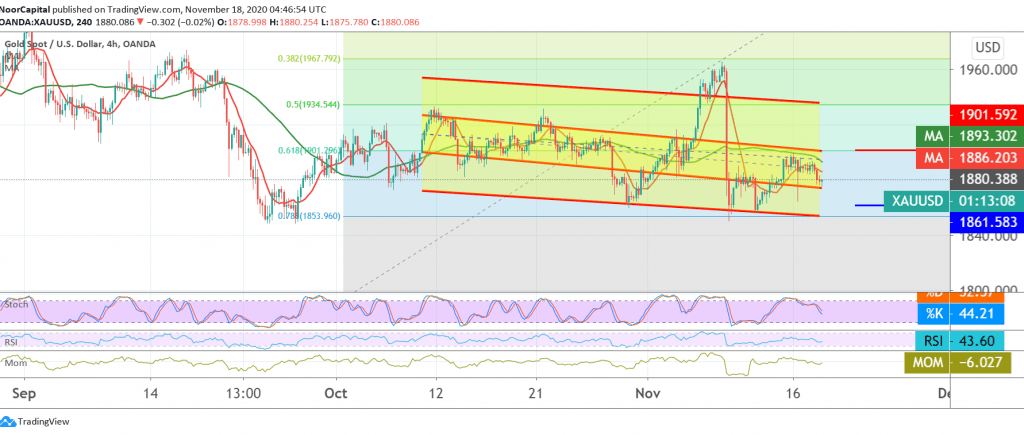

The yellow metal prices retreated significantly during the early trading session of the current session, after facing strong pressure from the 1901 resistance level, to hit the 1875 low.

Technically, the simple moving averages continue to pressure the price from the top, coinciding with the clear negative signs on the stochastic, gradually missing the bullish momentum.

From here, with the stability of trading below 1890 and the most important 1901, Fibonacci retracement of 61.80%, the bearish tendency is likely today, targeting 1871 as a first target, taking into account that confirming the breach of the aforementioned level extends gold’s losses so that we are waiting for 1860/1864

In general, we will continue to suggest the bearish trend unless we witness trading above 1901 because breaking it will negate any bearish scenario and gold will recover again with the aim of retesting 1934, the 50.0% Fibonacci retracement.

| S1: 1871.00 | R1: 1890.00 |

| S2: 1864.00 | R2: 1901.00 |

| S3: 1853.00 | R3: 1907.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations