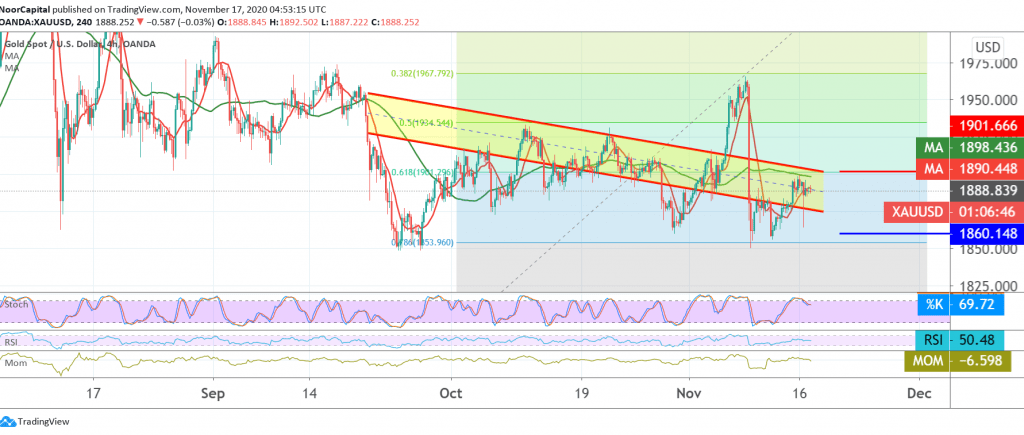

We committed to the intraday neutrality during the previous report due to the conflicting technical signals, explaining that the activation of short positions depends on a clear break of the 1890 support level, which puts the price under strong negative pressure to resume the bearish path with an initial target of 1860, gold recorded a low at 1864.

Technically, looking at the chart, we find the price consolidating above the support floor of 1860 with positive signs from the RSI on short time frames, Consequently, we might witness bullish attempts targeting a re-test of broken support-into-resistance 1901, Fib 61.80%.

Note: the aforementioned slight bullish bias does not contradict the downside trend, its initial targets are at 1800 once the low of 1860 is broken.

Note: The most important directional keys for the current trading levels are 1860 and 1901.

| S1: 1867.00 | R1: 1901.00 |

| S2: 1848.00 | R2: 1918.00 |

| S3: 1832.00 | R3: 1937.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations