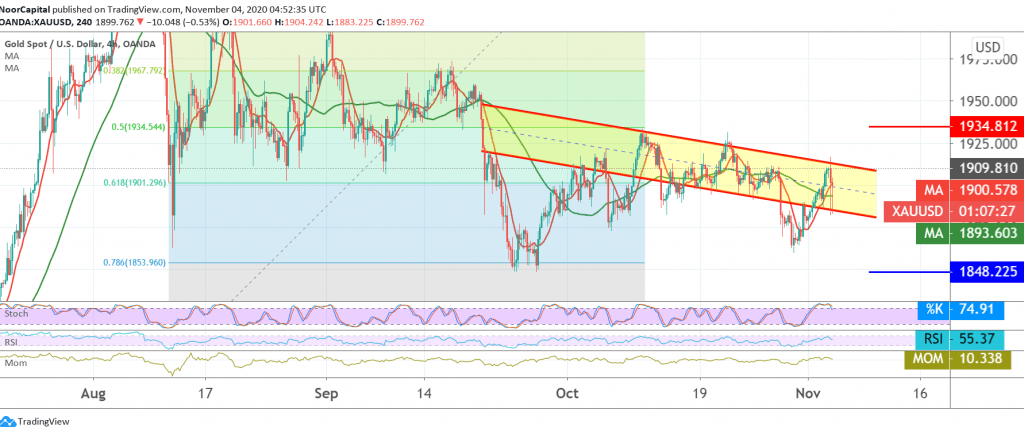

Gold moves witnessed positive attempts within an irregular path, in light of the increasing uncertainty about the US election results, to record a high of 1916 and a low of 1882.

Technically, prices were unable to stabilize above the resistance level of 1901, Fibonacci retracement of 61.80%, and we see negative signs dominating the stochastic.

Therefore, the bearish scenario remains more likely today, knowing that trading below 1882 facilitates the mission required to visit 1848 and may extend later towards 1794.

Confirmation of a breakout of the resistance level 1901 then 1906, a catalyst that increases the probability of retesting 1934, 50.0% retracement

The expected trading range for today is between 1794-1835. Warning: the level of risk may be high and not commensurate with the return.

| S1: 1882.00 | R1: 1916.00 |

| S2: 1865.00 | R2: 1933.00 |

| S3: 1848.00 | R3: 1950.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations