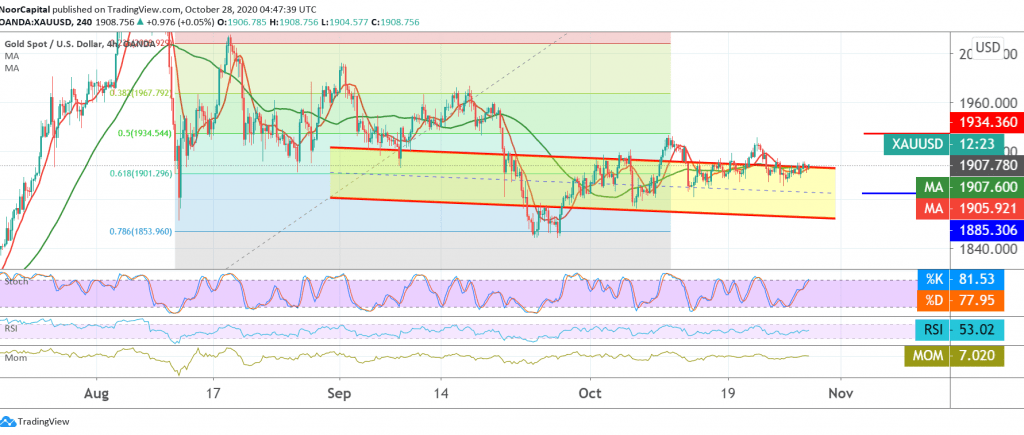

The yellow metal traded in a confined range, stable above 1901 and below 1912 over several sessions.

On the technical side, and looking at 240-minute charts, we see negative signs appearing on the stochastic indicator, with the MA-50 attempting to press the price from the top.

Although we tend to be negative, we prefer waiting for the confirmation of a break of the pivotal support 1901, 61.80% retracement, which represents a key protection for the upside, and breaking the mentioned level puts the price under negative pressure to 1891 and may extend to 1885.

The rise and the consolidation of the price above the resistance 1915/1913 postpones the chances of a reversal and pushes gold prices towards recovery so that we are waiting for the level of 1934, 50.0% retracement, one of the most important directional keys for the current trading levels.

| S1: 1899.00 | R1: 1913.00 |

| S2: 1891.00 | R2: 1919.00 |

| S3: 1885.00 | R3: 1927.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations