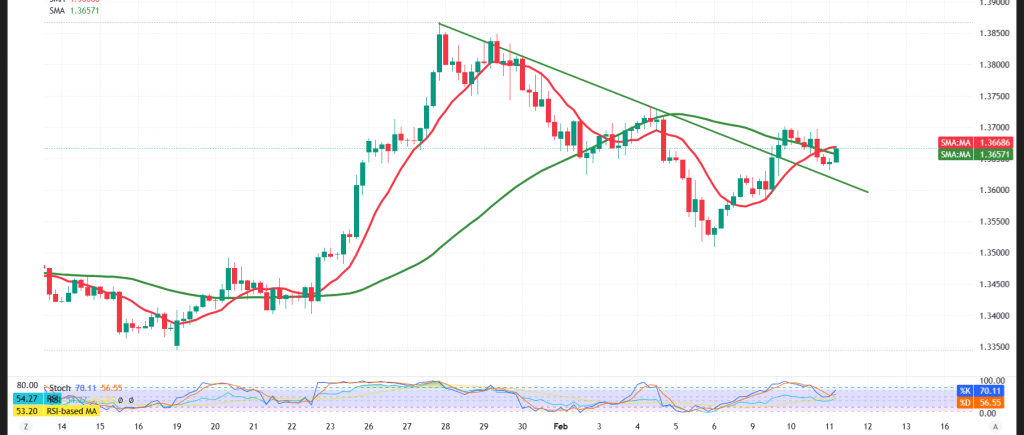

The GBP/USD pair successfully retested the key support level highlighted in the previous report at 1.3620, helping to preserve the broader upward bias and stabilize price action.

Technical Outlook – 4-Hour Chart

Simple moving averages have shifted back into a supportive role, providing positive momentum and reinforcing the potential for further gains during today’s session. This technical improvement is complemented by the Relative Strength Index (RSI), which is attempting to build additional upside momentum.

Expected Scenario

As long as daily trading remains above the 1.3620 support level, the bullish scenario remains the preferred outlook. Under this setup, a break above the 1.3700 resistance would likely pave the way for further gains toward 1.3730, followed by 1.3770.

On the downside, a return to trading below 1.3620 would weaken the bullish structure and could place the pair under temporary downward pressure, with scope for a corrective pullback toward 1.3545.

Market Note:

High-impact U.S. economic data is due today, including the Non-Farm Payrolls report, the unemployment rate, and average hourly earnings. Elevated volatility is expected around the release.

Caution:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3635 | R1: 1.3700 |

| S2: 1.3595 | R2: 1.3735 |

| S3: 1.3550 | R3: 1.3770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations