The technical outlook remains steady, with WTI crude oil futures showing limited movement while continuing to trade within an overall upward trend.

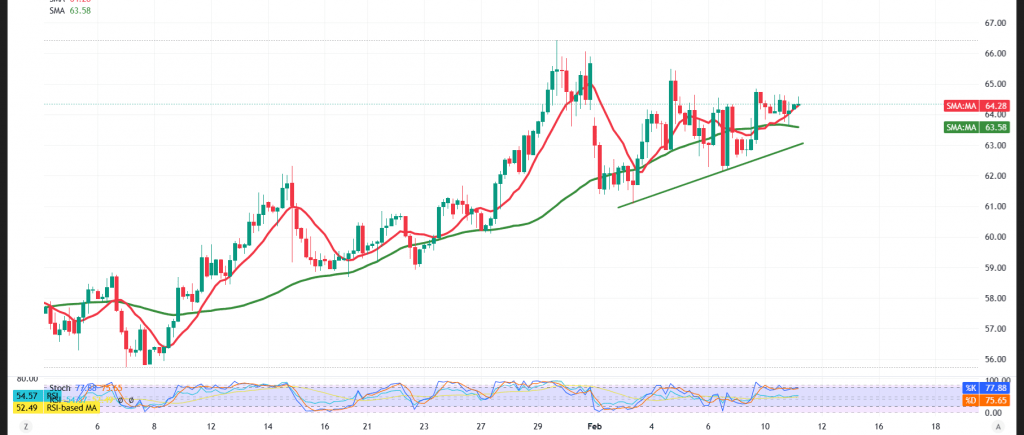

Technical Outlook – 4-Hour Chart

Simple moving averages remain supportive, underpinning the daily uptrend, while price action continues to respect a short-term ascending trendline. Momentum indicators also favor the bullish case, as the Relative Strength Index (RSI) has successfully worked off oversold conditions, creating room for potential further gains.

Expected Scenario

As long as prices hold above the $63.70 support level, the bullish scenario remains the most likely outcome. Under this setup, the first upside target stands at $64.80. A sustained break above this level would reinforce upward momentum and open the way toward $65.25.

On the downside, a return to trading below $63.70 would weaken the bullish structure and could place prices under renewed pressure, with scope for a corrective pullback toward $62.70.

Market Warning:

High-impact U.S. economic data is due today, including the Non-Farm Payrolls report, the unemployment rate, and average hourly earnings. Elevated volatility is expected around the release.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 63.80 | R1: 64.80 |

| S2: 63.25 | R2: 65.25 |

| S3: 62.70 | R3: 65.80 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations