U.S. crude oil futures are attempting to overcome their short-term weakness after posting notable gains in the previous session, rising toward the $60.50 area.

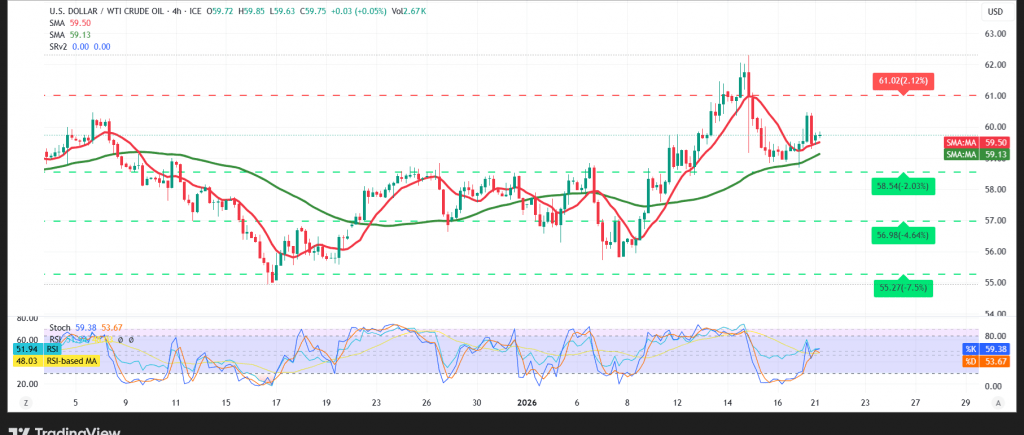

Technical Outlook – 4-Hour Chart

Despite recent volatility, the broader technical backdrop remains constructive. Simple moving averages continue to provide dynamic support from below, confirming that the prevailing trend remains tilted to the upside.

Momentum indicators also favor stabilization. The Relative Strength Index (RSI) is working to ease overbought conditions and establish a potential base, a development that could serve as a launchpad for a renewed advance.

As long as daily trading holds above the $58.80 support level, the bullish scenario remains the most likely path, with $60.50 standing as the next upside objective. A sustained break above this level would reinforce upward momentum and open the door toward $61.30.

On the downside, a confirmed break below $58.80 would temporarily invalidate the bullish setup and shift bias lower, with scope for a corrective pullback toward $57.90 before any renewed recovery attempts.

Market Note:

Markets are awaiting statements from U.S. President Donald Trump today, which could trigger heightened volatility.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 58.80 | R1: 60.50 |

| S2: 57.90 | R2: 61.35 |

| S3: 57.05 | R3: 62.25 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations