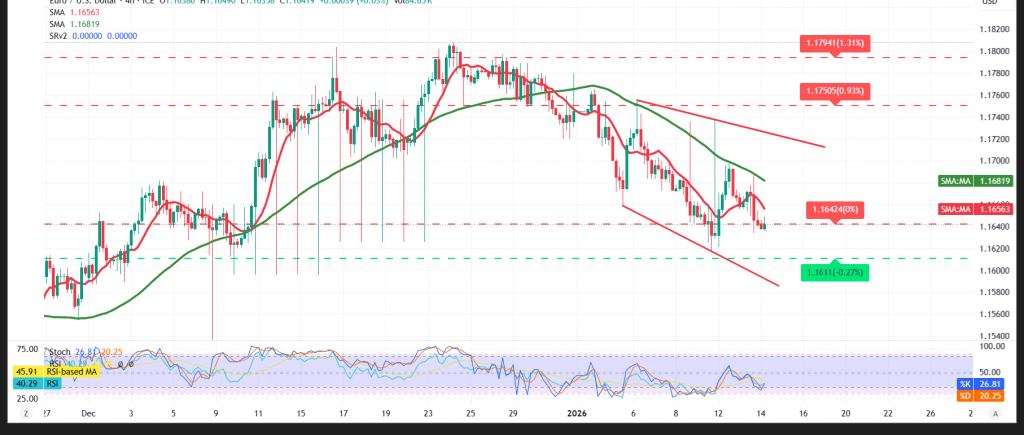

The EUR/USD pair continues to trade under bearish pressure, in line with our previous technical outlook, as price action remains capped below the key psychological barrier at 1.1700.

Technical Outlook – 4-Hour Chart

The 1.1700 level has once again proven to be a strong resistance zone, forcing the pair into a short-term bearish structure.

Simple moving averages continue to weigh on price action, acting as dynamic resistance and maintaining downside pressure. This is further supported by emerging negative signals on the Relative Strength Index (RSI), which point to fading bullish momentum and increase the probability of a gradual corrective decline toward lower levels.

Expected Technical Scenario

As long as trading remains below 1.1700 and within the descending corrective channel, the bearish bias remains the dominant scenario, with 1.1625 standing as the primary downside target. A break below this level would likely intensify selling pressure, opening the way toward 1.1585.

On the other hand, a decisive close above 1.1700 would signal a potential recovery attempt, with scope for a move toward a retest of the 1.1740 area.

Market Warning:

High-impact U.S. economic data is due today, particularly the monthly Producer Price Index (PPI) and Retail Sales figures. Elevated volatility is expected around the release, which may trigger sharp movements across major currency pairs.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1625 | R1: 1.1675 |

| S2: 1.1580 | R2: 1.1700 |

| S3: 1.1545 | R3: 1.1740 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations