The Dow Jones Industrial Average continues to post strong gains on Wall Street, closing above the 49,550 level and reinforcing the prevailing bullish momentum.

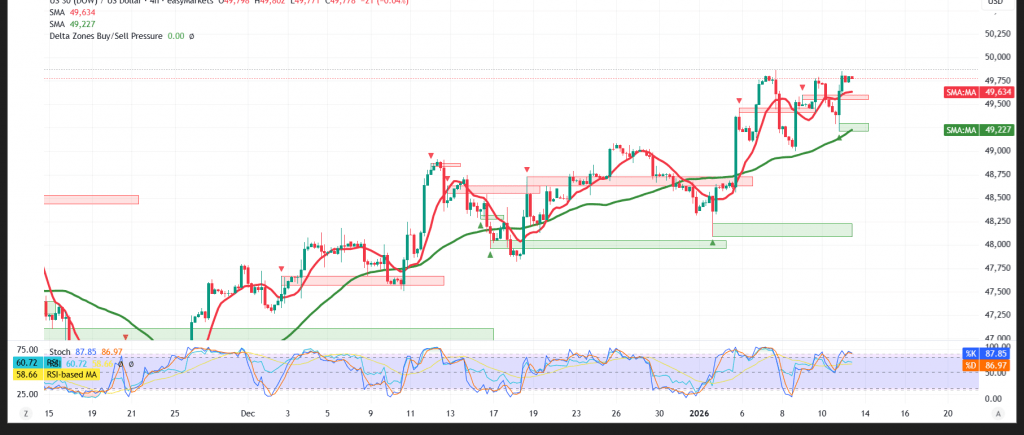

Technical Outlook – 4-Hour Chart

The 50-period Simple Moving Average (SMA) remains supportive, acting as a dynamic floor for price action and confirming the persistence of the upward trend.

Momentum indicators are aligned with this view, as the Relative Strength Index (RSI) continues to deliver positive signals, reflecting improving buying strength and sustained market confidence.

Expected Scenario

As long as daily trading holds above the 49,580 level, the path remains open for further gains, with 50,020 standing as the first upside target. A decisive break above this level could allow the index to extend its rally toward 50,260, provided no return below 49,580 occurs.

Market Note:

High-impact U.S. economic data is due today, most notably the monthly and annual Consumer Price Index (CPI). Elevated volatility is expected around the release.

Risk Warnings:

- Current market conditions carry a high level of risk, which may not be commensurate with potential returns.

- Ongoing trade and geopolitical tensions continue to heighten uncertainty, leaving all scenarios possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 49375 | R1: 50020 |

| S2: 48970 | R2: 50260 |

| S3: 48735 | R3: 50660 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations