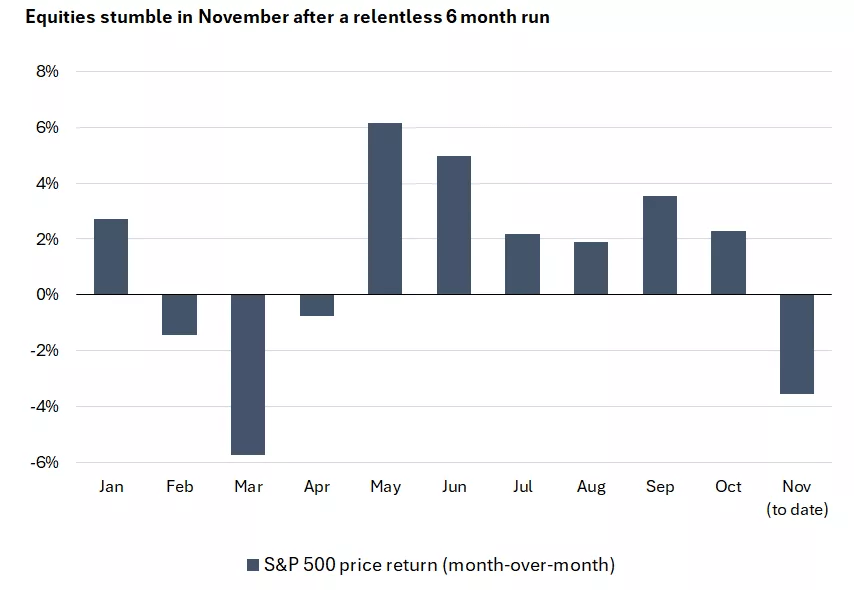

As a turbulent week concludes, global equities have faced notable volatility, extending a choppy downward trajectory that marks the worst decline since the US tariff-driven sell-off last April. The week was generally characterized by market instability, witnessing sharp daily swings as key indices like the S&P 500 experienced significant reversals amid investor concerns over economic data delays, geopolitical tensions, and shifting monetary policy expectations. The “Fear Index,” VIX, surged to levels not seen since early summer, reflecting the heightened uncertainty as traders navigate a landscape of incomplete economic reports due to the recent government shutdown.

Despite these pressures, companies in core sectors remain robust, suggesting the current decline may be a healthy rebalancing rather than the start of a prolonged downtrend.

Source: Bloomberg

While apprehension prevailed throughout the week, a rebalancing appears necessary following the S&P 500’s stunning 40.8% surge from its April lows. The week saw the S&P 500 drop by approximately 2%, underscoring the fragility of recent gains. Broader global markets echoed this negative sentiment, with European indices like the Euro Stoxx 50 falling over 1.5% and Asian indices such as the Nikkei 225 facing similar hurdles amid slowdown worries and supply chain disruptions. Emerging markets, however, showed relative resilience, buoyed by improving export data from regions like Southeast Asia.

Investors face two primary challenges: a slump in the technology space and the lack of clear signals surrounding the Fed’s upcoming policy decisions. Compounding this complex scene are international factors, including stalled US-China trade talks and Middle East tensions, which have contributed to rising commodity prices and stoked supply chain doubts. This downturn, however, may present an opportunity to emphasize portfolio diversification and capitalize on more attractive entry levels for selected assets, particularly in undervalued sectors poised for recovery. It is essential to focus on diversification across asset classes, sectors, and geographies to mitigate risk exposure, while exercising extreme caution and remaining closely informed of the latest market developments, economic data releases, and geopolitical events that may impact future trends.

Technology Under Scrutiny Amid AI Sector Drop

The AI-driven stocks, which have been the main engine behind this year’s market advance, are now showing signs of retreat. The “Magnificent Seven”—Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla—have collectively seen their market capitalization decline by 5.8% in November, leading to a parallel pullback in the broader indices. These pressures have notably impacted the Nasdaq Composite, which has dropped 6.65% month-to-date, reflecting a wider retreat in technology-heavy benchmarks.

Amid growing whispers on Wall Street of a potential AI valuation bubble, some companies are increasing debt to fund ambitious AI initiatives, which could pressure profit margins if returns do not materialize quickly. Nevertheless, the fundamentals for these large-cap firms remain strong, with robust earnings growth and a positive short-term outlook. Valuations, while elevated, have not reached the extremes of the bubbles observed before historical market crashes. Analysts caution that additional emotion-driven declines are possible, but advise against knee-jerk reactions to temporary volatility.

Nvidia Earnings Spark: A Quick Rally Fades

Market tensions were particularly evident leading up to Nvidia’s Q3 earnings release. The chip giant delivered stellar results, including revenue of $57 billion—surpassing Wall Street estimates and guidance of $54.9 billion—with revised upward guidance and positive signals about long-term AI demand. However, the initial 4.8% rally at the open faded, closing the stock down 2.3%, marking only the ninth reversal since 1957 for an S&P 500 stock that opens 4% or higher on earnings day.

This sudden turn stems from two main concerns: slowing growth expectations from the explosive pace of recent quarters, and mounting worry about the long-term return viability of massive AI investments. Nvidia CEO, Jensen Huang, directly addressed bubble concerns, stressing sustained demand but acknowledging the company’s “delicate situation” amid heightened anticipation for its stock performance. Despite the post-earnings dip, Nvidia’s stock is up 50.8% year-to-date, highlighting its pivotal role in the AI narrative.

The Fed’s Dilemma: Data Delays and Divided Opinions

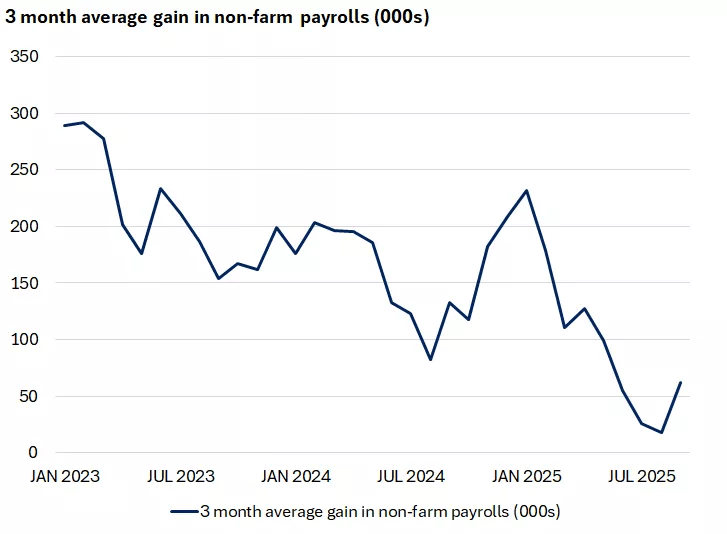

Adding to the market’s unease is the challenge the Fed faces in deciphering economic signals amid the disruptions caused by the historic 43-day government shutdown. The delayed September Nonfarm Payrolls report, released on November 21st, revealed a stronger-than-expected addition of 119,000 jobs, but this was tempered by downward revisions to prior months and a jump in the unemployment rate to 4.4%—a four-year high.

Source: Haver Analytics

Critical October and November data, including jobs and CPI reports, remain partially unavailable before the Fed’s December 10-11 meeting, creating a non-ideal environment for the US central bank focused on its dual mandate of addressing inflation and employment.

Following two consecutive rate cuts, inflation remains above the 2% target, with September’s CPI at 3.0% year-over-year and Core PCE estimated at 2.7-2.8% for October. More hawkish FOMC members have voiced concerns that any further easing or rate cuts could embed higher prices and pressure living conditions for Americans. Market pricing for a 25-basis-point cut in December has swung wildly, falling from near-certainty in late October to below 30% before rebounding to 71% as of November 22nd.

Broader Market Shifts:

The AI-sector sell-off sparked a notable rotation toward sectors such as Healthcare, Materials, and Energy. US stock futures reflected a mixed sentiment early on Friday, November 21st, with the Dow Jones up 0.3%, the S&P 500 down 0.1%, and the Nasdaq 100 down 0.5%. For the week, risk-off sentiment prevailed, leaving the S&P 500 down 2.9%, the Dow Jones around 3%, and the Nasdaq 3.6%.

Internationally, economic indicators painted a mixed picture. UK retail sales dropped 1.1% month-over-month in October, suggesting fragile consumer demand that could push the Bank of England toward a December rate cut. The UK CPI eased to 3.6% year-over-year in October, the lowest since May, adding to disinflationary evidence and supporting the case for monetary easing amid weak growth.

In Germany, the November PMI Composite fell to 52.1, with manufacturing contracting further at 48.4, highlighting industry woes despite resilient services. Eurozone Consumer Confidence stalled at -14.2 in November, weaker than expected, putting pressure on the Euro amid geopolitical tensions and trade disputes.

Crypto and Commodities: Risk-Off Sentiment Reigns

Volatility extended beyond equities into cryptocurrencies and commodities. Bitcoin fell to $83,770, down 6.8% on Friday, with a weekly loss of nearly 8%—its worst since April. Market drivers included the US jobs data and a large holder sale, with effects spreading to Ethereum (-7% to $2,810), Solana (-8%), and other crypto assets. MicroStrategy stock faced a notable challenge as Bitcoin neared its cost basis of $74,430.

Oil prices continued to fall, with Brent Crude seen at $61.60 per barrel on Friday, November 21st, down 2.2% with weekly losses of about 4%, while US WTI Crude retreated 1.6% to close at $58 per barrel. Factors included an easing of Russia-Ukraine tensions potentially relieving supplies, doubts about new US sanctions on Russian entities, and the strong US Dollar Index (DXY) at 100.196 amid diminishing Fed rate cut hopes. Simultaneously, Gold fell to $4,065.01 per ounce, down 0.31%, with dollar strength linked to monetary concerns in Japan and uncertainty over the Fed’s policy path.

Silver: Industrial Demand Clashes with Uncertainty

Silver exhibited heightened volatility over the week ending November 21, 2025, reflecting its dual role as an industrial metal and a safe-haven asset. The metal closed sharply lower on Friday at approximately $50.02 per ounce, down 1.28% from the previous session. Earlier, silver saw gains of 1.3% to $51.38 per ounce, supported by positive US manufacturing data according to the New York Empire State Index, which rose to 18.7—a one-year high—and signaled strong industrial demand.

Global silver demand is forecast to drop 4% year-over-year to 1.12 billion ounces in late 2025, driven by a slowdown in key sectors like electronics and solar energy, yet a supply deficit persists for the fifth consecutive year.

Currencies Under Pressure: Dollar Strength Squeezes Majors

The US Dollar Index (DXY) closed at 100.196, down 0.02%, reflecting a slight retreat but remaining generally strong. This dollar strength contributed to pressure on major pairs. The EUR/USD pair closed at 1.15105, down 0.15%, with Eurozone indicators like consumer confidence near recessionary levels at -14.2, highlighting Eurozone weakness including trade tensions and geopolitical risks.

Similarly, the GBP/USD pair closed at 1.30958, up 0.19% despite the broader challenges facing the Pound Sterling, with UK retail sales down 1.1% in October, which may in turn influence the Bank of England’s forthcoming decisions.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations