Dollar strength post-jobs data dragged gold back into a downtrend.

Technical outlook

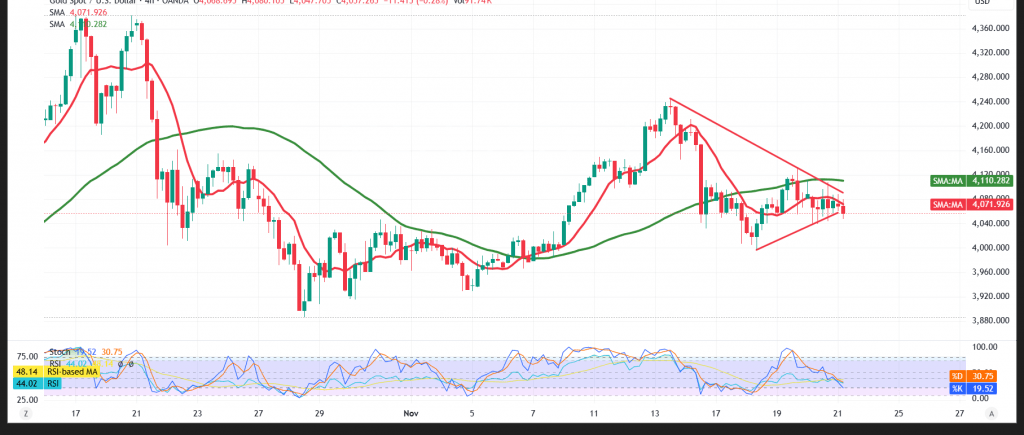

- SMAs: Overhead and acting as stiff dynamic resistance, capping rebounds.

- RSI: Persistently negative, confirming weak buying pressure.

Base case (bearish while below $4,085 / $4,095)

- Staying beneath $4,085–$4,095 keeps downside risks dominant.

- A decisive break/4H close below $4,038 would likely target $4,023 first; below that opens $3,995.

Invalidation / upside toggle

- Reclaiming and holding above $4,095 would negate the setup and allow a rebound toward $4,110.

Event risk

- High-impact releases today: UK Retail Sales, prelim Manufacturing/Services PMIs for the UK, Eurozone, and US. Expect elevated volatility around the prints.

Risk note

Gold trading carries elevated risk and may not suit all investors. Use prudent sizing and firm stops, and reassess quickly if the key levels give way.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4023.00 | R1: 4096.00 |

| S2: 3995.00 | R2: 4140.00 |

| S3: 3952.00 | R3: 4168.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations