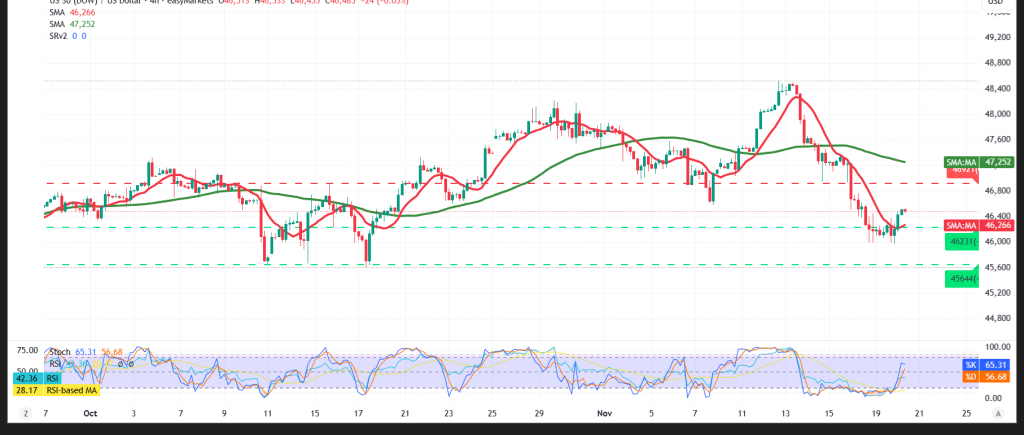

After several down sessions, the index attempted a rebound, reaching a 46,516 high.

Technical outlook

- 50-SMA (4H): Rolling over above price as a descending ceiling, consistent with the broader daily downtrend.

- RSI: Trying to stabilize around the 50 line, but positive momentum is not yet confirmed.

Trade map (wait for confirmation)

- Bearish continuation: A decisive break/4H close below 46,260 would likely resume the down leg toward 46,140; below there exposes 45,785.

- Recovery path: Reclaiming and holding above 46,685 would put a retest of 46,870 in view.

Event risk

- U.S. NFP, unemployment, and average earnings today could trigger sharp volatility—tighten risk controls around the release.

Risk note

Volatility is elevated and may be disproportionate to potential returns. Use prudent sizing and firm stops; reassess quickly if either trigger level gives way.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46140 | R1: 46685 |

| S2: 45785 | R2: 46870 |

| S3: 45595 | R3: 47230 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations