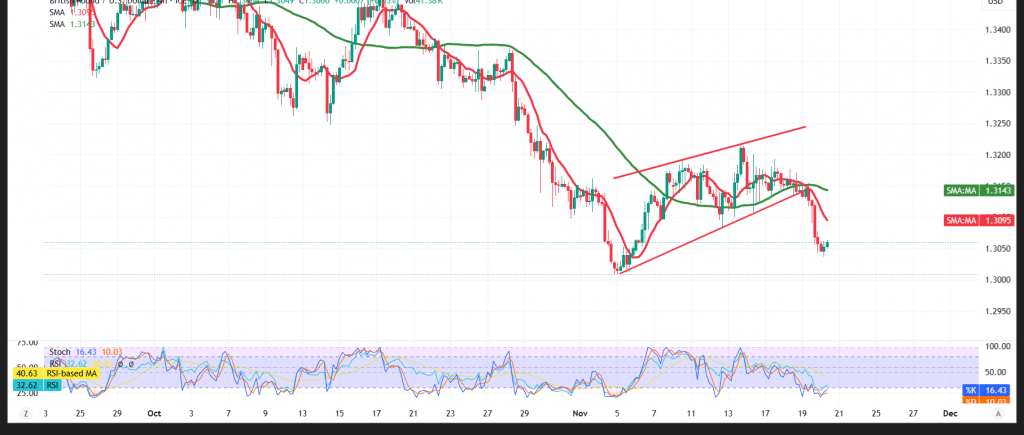

Sterling extended losses in line with our prior view, breaking 1.3075 and printing a 1.3038 low.

Technical outlook

- SMAs: Sitting overhead as dynamic resistance, curbing rebound attempts.

- RSI / pattern: Momentum remains negative and a bearish structure persists, reinforcing the daily downtrend.

Base case (bearish continuation)

- A decisive break/4H close below 1.3040 would likely press toward 1.3015.

- Below 1.3015 exposes 1.2970, then 1.2895.

Invalidation / recovery path

- A confirmed 1H close above 1.3130 would ease immediate downside pressure and allow a corrective push toward 1.3200.

Event risk

- U.S. NFP, unemployment, and average earnings today may trigger sharp volatility—tighten risk controls around the release.

Risk note

Volatility is elevated. Use prudent sizing and firm stops; reassess quickly if the trigger levels give way.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3015 | R1: 1.3130 |

| S2: 1.2970 | R2: 1.3200 |

| S3: 1.2895 | R3: 1.3250 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations