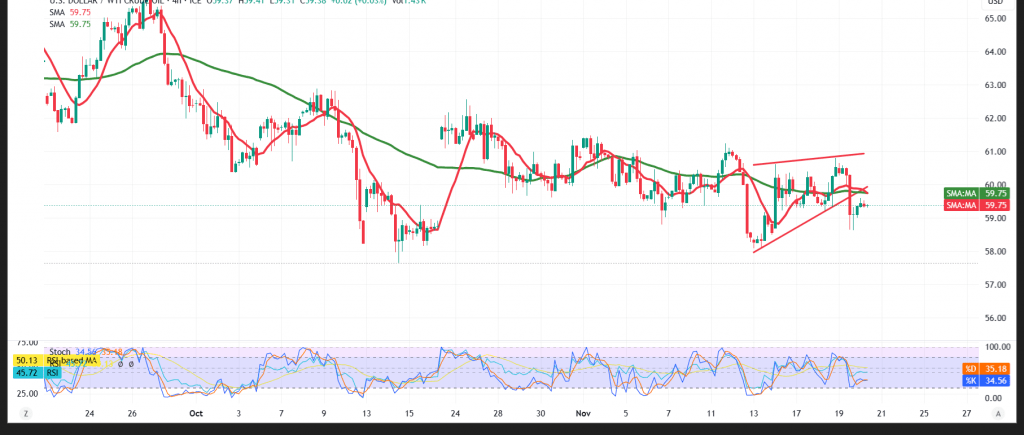

WTI reversed lower after failing to hold above $60.00, sliding to a $58.70 low.

Technical outlook

- 50-SMA (4H): Price is trading below the average, adding downside pressure.

- Pattern/structure: A developing bearish setup (with lower highs) supports continuation risk to the downside.

Base case (bearish while below $60.00 / $60.45)

- A decisive break/4H close below $58.90 would likely press toward $58.50, then $57.60 if momentum builds.

Invalidation / bounce path

- Reclaiming and holding above $60.45 would neutralize immediate downside and open room for a corrective recovery.

Event risk

- U.S. NFP, unemployment, and average earnings today could spark sharp volatility—tighten risk controls around the release.

Risk note

Backdrop remains headline-sensitive. Use prudent sizing and firm stops; reassess quickly if trigger levels give way.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 58.50 | R1: 60.45 |

| S2: 57.60 | R2: 61.55 |

| S3: 56.55 | R3: 62.40 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations