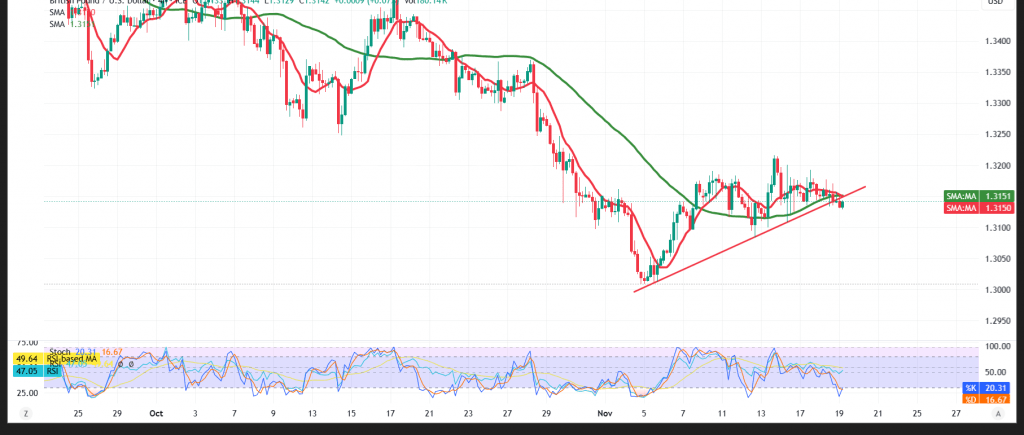

GBP/USD — 4H Technical Update

The setup is broadly unchanged: price action is muted and the downtrend remains the dominant theme.

Technical outlook

- RSI: Still printing negative signals despite oversold readings—evidence of persistent bearish momentum.

- 50-SMA (4H): Price is holding above the average, providing some underlying support—hence the mixed picture.

Trade map (wait-for-confirmation)

- Bearish trigger: A decisive break/4H close below 1.3130 would likely extend the slide toward 1.3100, then 1.3075.

- Bullish trigger: A confirmed 1H close above 1.3190 would open scope for a corrective push toward 1.3220.

Event risk

- FOMC minutes today could inject volatility—consider tighter risk controls around the release.

Risk note

Backdrop remains headline-sensitive. Use prudent sizing and firm stops; reassess quickly if either trigger level gives way.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3135 | R1: 1.3190 |

| S2: 1.3100 | R2: 1.3220 |

| S3: 1.3075 | R3: 1.3255 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations