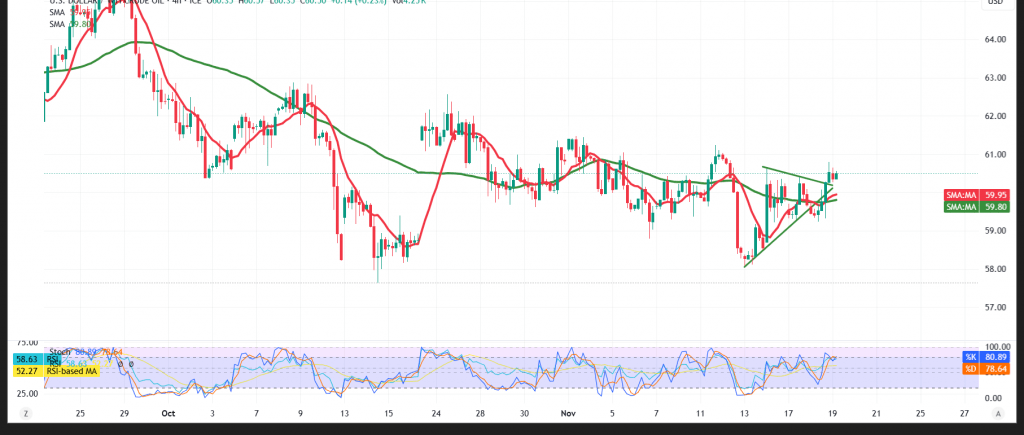

WTI caught a bid after basing near $59.30, with buyers regaining traction.

Technical outlook

- 50-SMA (4H): Price has reclaimed and is stabilizing above it, adding positive momentum.

- RSI: Turning constructive, supporting the recovery attempt.

Base case (bullish bias while above $60.10 / $59.80)

- Holding $60.10—and more broadly $59.80—keeps the topside in focus.

- A clean break/hold above $61.10 would likely extend toward $61.70.

Alternative / downside

- A return and close below $59.60 would hand control back to sellers and reopen $58.70.

Event risk

- FOMC minutes today may spur volatility—consider tighter risk controls around the release.

Risk note

Backdrop remains headline-sensitive. Use prudent position sizing and firm stops; reassess quickly if these levels give way.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 59.60 | R1: 61.10 |

| S2: 58.70 | R2: 61.70 |

| S3: 58.05 | R3: 62.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations