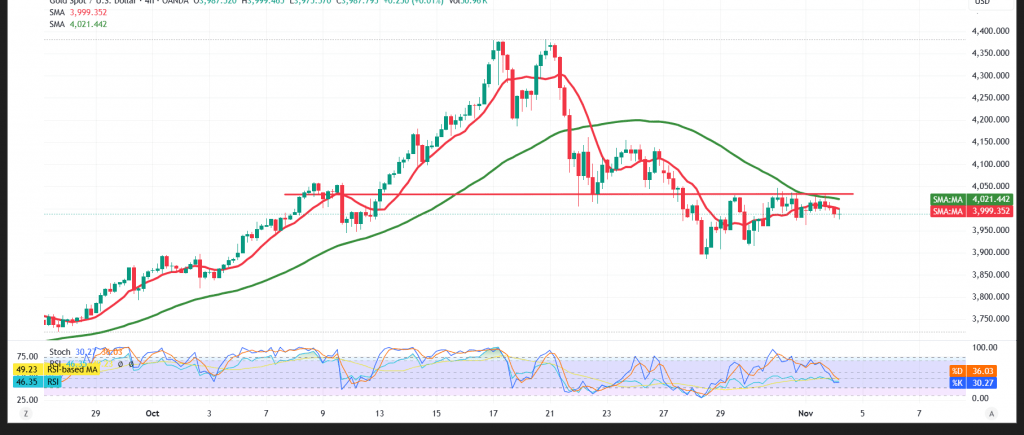

Gold briefly shook off selling pressure after probing the $3,928 support, rebounding toward the $4,000 area.

Technical outlook

- SMAs: Attempting to rotate beneath price, offering support from below and mild positive momentum.

- RSI: Turning constructive after a reset, aligning with scope for further recovery attempts within a broader corrective downtrend.

Base case (bullish bias while above $3,970)

- Holding $3,970 favors a topside push.

- A decisive break/4H close above $4,000 would likely open ~$4,022 next.

Alternative / downside

- A sustained 1H close back below $3,970 would revive the corrective downtrend, targeting $3,940, then $3,915.

Risk note

Gold’s risk profile is elevated and may not suit all investors. Use prudent sizing and hard stops; reassess quickly if these key levels give way amid trade and geopolitical headlines.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3968.00 | R1: 4022.00 |

| S2: 3940.00 | R2: 4047.00 |

| S3: 3915.00 | R3: 4076.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations