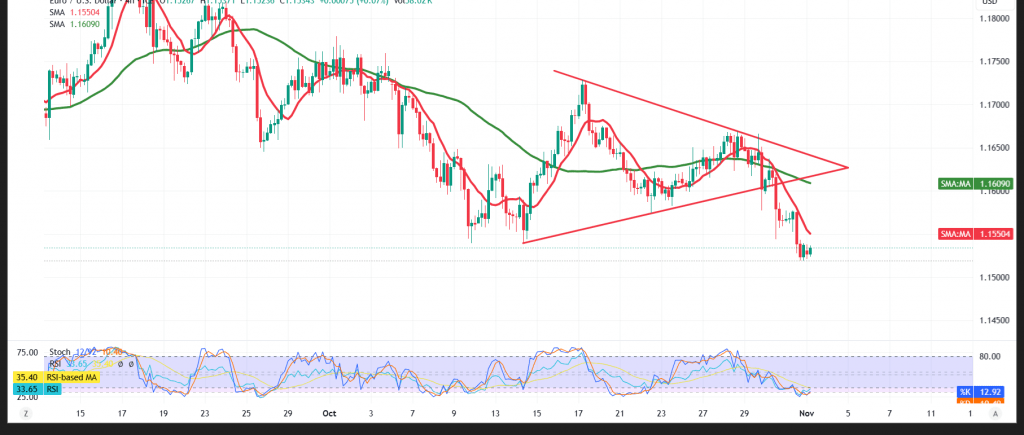

The pair extended last week’s downtrend in line with our bearish view, reaching the first target at 1.1550 and posting a 1.1532 low.

Technical outlook (4H)

- RSI: Deep in oversold territory, which may prompt a brief corrective bounce before the primary downtrend resumes.

- SMAs & structure: Price remains below the simple moving averages and continues to respect a descending trendline, keeping recovery attempts capped.

Base case (bearish while below 1.1560/1.1600)

- Maintaining trade below 1.1560—and more broadly below 1.1600—keeps the downside favored.

- A clean break/4H close beneath 1.1550 would expose 1.1500, then 1.1450.

Invalidation / upside toggle

- Reclaiming 1.1600 and then 1.1630 would neutralize immediate downside pressure and allow a limited corrective move higher.

Risk note

Volatility remains elevated amid trade tensions; use prudent sizing and hard stops. Scenario probabilities can shift quickly if these levels break.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1500 | R1: 1.1560 |

| S2: 1.1450 | R2: 1.1595 |

| S3: 1.1420 | R3: 1.1630 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations