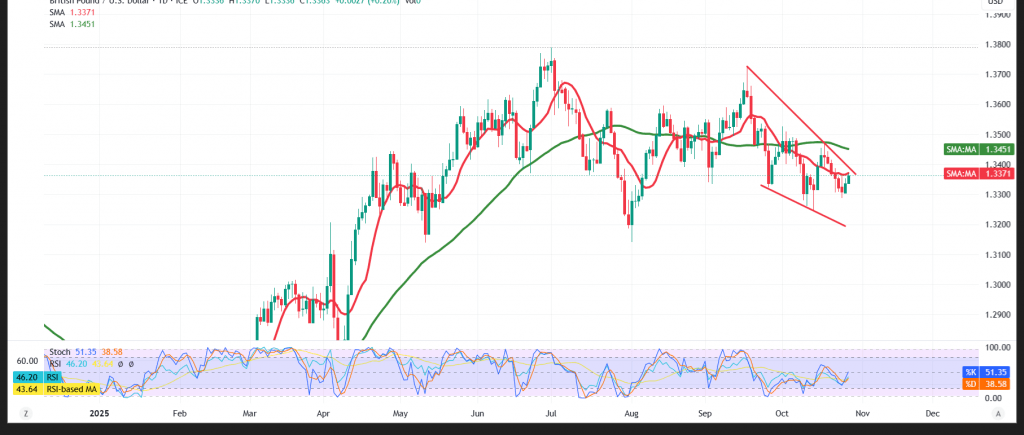

Cable staged a strong early-week rebound after defending 1.3300. However, momentum is stalling beneath nearby resistance.

Technical picture

- RSI (H4) is edging into overbought territory and rolling over, a cautionary sign of waning upside momentum.

- Price action remains capped below 1.3380–1.3390, tempering the rebound and keeping risk of a pullback in play.

Base case (bearish tilt)

While 1.3380 holds, the intraday bias favors a drift lower to 1.3325 (initial support).

A decisive break below 1.3325 would likely extend losses toward 1.3280.

Alternative case (bullish resumption)

An hourly close above 1.3390 would invalidate the near-term bearish setup and re-open the topside toward 1.3420, then 1.3450.

Key levels

- Support: 1.3325, 1.3300, 1.3280

- Resistance: 1.3380, 1.3390, 1.3420, 1.3450

Risk note

Market conditions remain headline-sensitive; volatility can be elevated. This analysis is for information only and is not investment advice.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3325 | R1: 1.3390 |

| S2: 1.3280 | R2: 1.3415 |

| S3: 1.3255 | R3: 1.3455 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations