Global markets are anticipated to face a week full of pressure and fundamental factors that cannot be overlooked. The new trading week is dominated by a trifecta of high-impact events: first, undoubtedly, the widely expected Federal Reserve interest rate decision; second, the release of more earnings reports from major technology companies; and third, a crucial meeting between President Donald Trump and his Chinese counterpart, Xi Jinping.

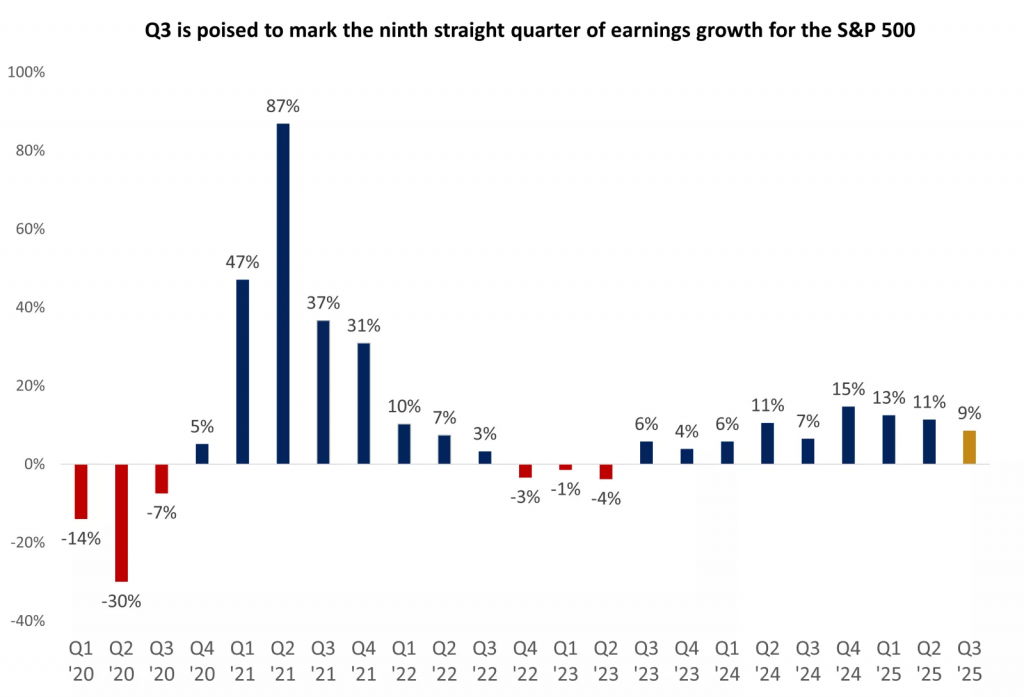

Source: FactSet

While stock indices have surged to new record levels, the majority of observers caution against excessive complacency. The inherent risks in these events are not only related to short-term volatility but also to the fundamental drivers of the current upward momentum in U.S. stocks and the potential for a sudden or sharp reversal.

The Federal Open Market Committee (FOMC) is widely expected to enact another quarter-point interest rate cut. This expectation is largely based on the September Consumer Price Index (CPI) report, which revealed that inflation eased to an annual rate of 3.0%. This data provided a green light for Federal Reserve Chairman Jerome Powell and the FOMC, signaling moderating inflation even as they grapple with a severe lack of recent labor market data due to the ongoing government shutdown.

While lower interest rates help reduce corporate borrowing costs and theoretically support higher equity valuations, they also signal economic weakness. Historically, the period immediately following the first rate cut in a cycle has been mixed for the S&P 500, with declines of over 20% occurring after the first cut in more than half of the historical instances.

The consequences of the government shutdown are becoming more acute for millions of Americans as the crisis persists and an agreement on reopening federal agencies remains elusive. President Donald Trump traveled on a six-day international trip, leaving the capital, while members of Congress remain mired in deep partisan disagreements over healthcare policy. The fallout from the shutdown is rapidly escalating, affecting food assistance programs as well as disruptions in the travel sector and essential services. The Secretary of Transportation warned that staffing shortages at air traffic control towers, resulting from ongoing stress on air traffic controllers and Transportation Security Administration (TSA) workers operating without pay, will lead to more flight delays and cancellations in the coming days.

Major Currencies and Commodities:

Amid the focus on common factors driving global markets, especially U.S. interest rate expectations and geopolitical risks, the following lines offer a glimpse into the performance of major currencies and commodities:

The recent performance of major currencies and commodities has revolved around three main axes: the Federal Reserve’s interest rate expectations, the strength of U.S. economic activity, and geopolitical risks.

1) Major Currencies

A. The U.S. Dollar – The Reluctant Leader: The U.S. Dollar remained the main force in the market but faced significant volatility:

Negative Impact: Weaker-than-expected U.S. inflation data (CPI) boosted market bets on a Federal Reserve rate cut, pressuring the dollar.

Positive Impact: The dollar recovered after strong U.S. Purchasing Managers’ Index (PMI) data was released, signaling continued resilience in business activity, limiting the attractiveness of other currencies. The dollar traded in a defined range, supported by the strength of the U.S. economy but constrained by rate-cut expectations amplified by the disappointing inflation data.

B. The Euro – Internally Supported, Externally Burdened:

The Euro received support thanks to a noticeable improvement in the Eurozone PMI indices, suggesting a rebound in economic activity.

Pressures on the Euro: The Euro’s gains were curtailed by political and financial risks, particularly after Moody’s downgraded France’s outlook to negative due to debt-related risks. The EUR/USD pair ended the last trading week with minor losses.

C. The British Pound – Weak Bank of England Expectations: The British Pound declined sharply against the Euro, despite strong retail sales data. The reason lies in the fact that weaker U.K. inflation data reinforced market expectations that the Bank of England is heading toward an earlier interest rate cut, reducing the Pound’s appeal as a high-yield currency.

D. Continued Pressure on the Japanese Yen: The Yen remains under persistent pressure, especially against the U.S. Dollar, primarily due to fundamental reasons, most notably the continued large yield differential between the U.S. and Japan as a key driver, with the Bank of Japan remaining committed to an ultra-accommodative monetary policy.

E. The Australian Dollar: The Australian Dollar traded in a relatively narrow range and was affected by the fluctuations in U.S. data; it briefly rose with the weak inflation data then retreated as the Dollar recovered after the strong PMI purchasing data, but it lacks a strong catalyst for a change in direction.

F. The Canadian Dollar – Sensitivity to U.S. Trade Disputes and Weak Growth: The Canadian Dollar registered a slight decline, affected by weak consumer spending growth in August and expectations of weakness in September, alongside concerns related to trade tensions with the U.S., which were manifested by the cancellation of trade negotiations. Expectations point toward a potential interest rate cut by the Bank of Canada.

2. Commodities – Gold: Gold prices recovered strongly after an initial two-day decline. The main catalyst for the recovery was: the weaker U.S. inflation data, which bolstered rate cut expectations as a key driver for the rise in gold. It is also worth noting that continued geopolitical tensions contribute to supporting the momentum and future expectations for gold as a favored “safe haven.”

B. Silver: Silver prices saw some volatility after their recent rise, stabilizing around the $49 level. As with gold, silver drew support from the increased expectations of monetary policy easing by the Federal Reserve. Slight pressure on the dollar and lower bond yields also served precious metal prices.

Oil Markets this Week:

Oil markets experienced a period of consolidation and movement within a narrow range last week after weeks of sharp declines. Both Brent and West Texas Intermediate crude managed to record modest weekly gains despite closing slightly lower on Friday. U.S. crude settled at $61.44 per barrel while Brent closed at $65.84. This calm performance reflects a delicate balance between conflicting supply and demand factors.

Investors and traders boosted optimism regarding the expected consumption of heating fuel with the approaching winter season. However, concerns about global economic growth and inventory build-up prevented any strong and sustained rise in prices.

Escalation of the War on the “Energy Front”:

The most significant factor in market dynamics was the shift in focus of the conflict between Russia and Ukraine to energy assets as winter approaches. While geopolitical risks have generally calmed as a daily factor, recent developments have increased the long-term risks to Russian oil supply. The U.S. and Europe imposed new and comprehensive sanctions targeting the heart of the Russian oil industry, specifically Lukoil and Rosneft, which account for about half of Russia’s crude oil production. These measures aim to cut off funding for the Russian war machine, potentially leading to a decline in Russian supplies if key buyers like India reduce their imports.

Ukrainian Attacks on Refining Facilities: Ukraine continued its strategy of launching long-range drone attacks that damaged approximately 20% of Russia’s refining capacity. This led to a sharp gasoline shortage in some Russian regions, posing a direct pressure on Russia’s ability to process its oil.

Threat to Disrupt Ukrainian Supplies: In response, Russia is waging a destructive campaign against Ukrainian electricity and gas infrastructure, resulting in power shortages and a rising need for gas imports.

Cryptocurrencies: Bitcoin climbed above $111,000, supported by easing trade tensions between the United States and China and cooling U.S. inflation. The confirmed meeting between Presidents Trump and Xi boosted investor risk appetite towards digital assets and equities. Concurrently, U.S. inflation data showed moderation (up 0.3% in September), increasing expectations that the Federal Reserve might cut interest rates. The surprising developments also included President Trump issuing a full pardon to Changpeng “CZ” Zhao, the founder of Binance. Other major cryptocurrencies, such as Ethereum and XRP, followed Bitcoin’s upward trend.

The current environment, in which the S&P 500 is trading at high multiples – with a price-to-earnings ratio significantly exceeding its five-year average – adds to the caution. The Federal Reserve is inevitably responding not only to the elevated employment risks indicated by private sector indicators and state-level jobless claims, which highlights that the rate cut is a necessary response to a slowing economy amid the disruption of critically important data due to ongoing political disputes and the continued shutdown.

The success of the current bull market has been deeply concentrated in mega-cap technology companies – often dubbed the “Magnificent Seven” – all of which are scheduled to release their reports this week. It is noteworthy that their sheer size means their collective performance can dictate the direction of the S&P 500 index.

For instance, the top ten stocks now account for nearly 40% of the S&P 500’s market capitalization. The key question for investors is whether their massive capital spending on Artificial Intelligence (AI) infrastructure – which is expected to be a significant portion of the index’s total capital expenditures – will start translating into superior earnings growth and justify their elevated valuations.

The “Magnificent Seven” are expected to continue to outperform the rest of the S&P 500 in terms of growth, but their valuation premium is substantial, with the group trading at a 34% premium compared to the broader index. The market has priced in strong earnings growth for the next two years, setting an incredibly high bar for this week’s results. Any disappointment in the AI narrative could lead to a significant revaluation of these high-flying stocks. Future bull market leadership may need to broaden, relying on improving fundamentals across cyclical sectors like Industrials, Energy (with the two major companies Exxon Mobil and Chevron reporting this week), and Discretionary Consumer goods, instead of remaining confined to a narrow group of technology giants.

Geopolitical Headwinds and the Fragile Trade Truce:

Topping the geopolitical agenda is the anticipated meeting between President Donald Trump and Chinese President Xi Jinping. Recent reports from U.S. officials, including Treasury Secretary Scott Peacent, indicate that a “very substantial framework” has been reached to avert threatened 100% tariffs and allow for the postponement of China’s newly expanded rare earth metal export controls.

This represents a significant, albeit fragile, de-escalation of the trade conflict that had sharply intensified. China’s reliance on rare earth metal controls – which are vital for U.S. electronics and defense supply chains – exposed how resource dominance has now become a geopolitical leverage tool. While the framework agreement offers immediate relief, it is a temporary truce, not a final solution. The fundamental structural issues underlying the trade war, from intellectual property to economic competition, remain unresolved.

Furthermore, U.S. sanctions against major Russian energy companies like Rosneft and Lukoil add another layer of global risk, potentially pushing crude oil prices higher and translating into higher costs for consumers.

These interconnected global tensions underscore the danger of the current market optimism. The high-risk events this week – indicating policy shifts based on incomplete data, a major test of corporate valuation, and sensitive trade negotiations – demand vigilance, moving beyond headline numbers, and maintaining a reasonable level of caution. Stock markets have been climbing the “wall of worry” for some time; this week will test whether that wall is stable, or if its foundations are finally starting to crack.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations