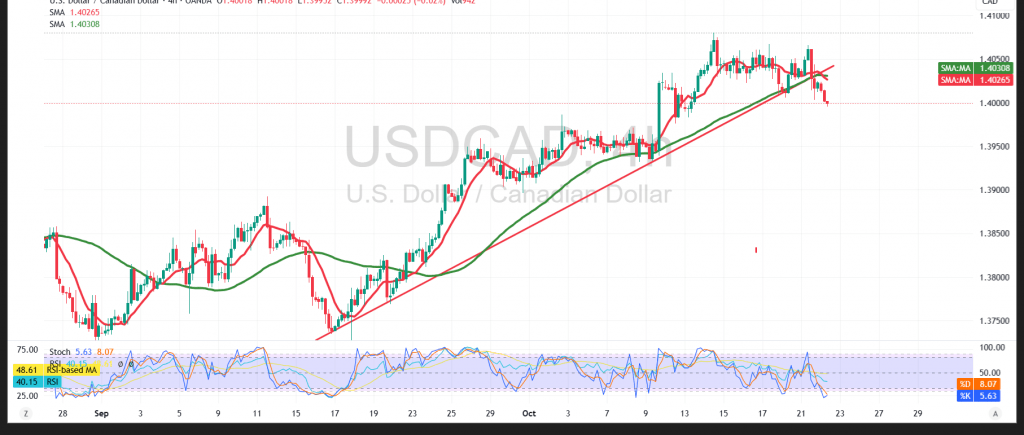

USD/CAD turned lower after failing at 1.4060, with price action slipping into negative trades and stabilizing around the 1.4000 pivot as sellers probe for follow-through.

Technical:

The pair broke its ascending support line, and simple moving averages have flipped to overhead resistance, reinforcing a near-term bearish tilt on the 4-hour chart while price holds below the short-term downtrend cap.

Base case:

While below 1.4045, downside pressure is favored, with scope to 1.3970 first and 1.3940 as the next support area if momentum persists.

Alternative:

A decisive break and hold above 1.4045 would neutralize immediate downside risk and could accelerate a retest of 1.4090.

Risk:

Geopolitical/trade headlines can trigger abrupt two-way moves. Use disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3970 | R1: 1.4045 |

| S2: 1.3940 | R2: 1.4090 |

| S3: 1.3905 | R3: 1.4115 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations