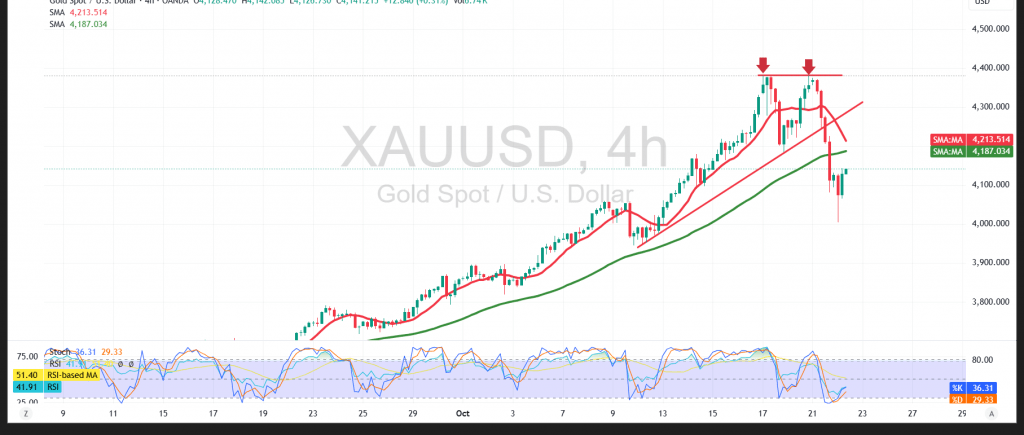

Gold (XAU/USD) sold off sharply after failing to reclaim the $4,380 pivot, in line with the prior bearish bias. The drop forced a retest of $4,245 and extended to a $4,005 low before stabilizing.

Technical:

A clear double-top has formed, reinforcing short-term seller control. Price holds below down-sloping SMAs, which are acting as dynamic resistance and capping corrective bounces. The $4,000 area has flipped from support to resistance, keeping the near-term structure bearish.

Base case:

While below $4,000, downside risk prevails. A sustained push lower would keep $3,965 in focus, with scope to $3,900 if momentum persists.

Alternative:

A decisive break and close above $4,334 would ease immediate pressure and could re-open $4,380, with extension potential toward $4,540 on follow-through.

Risk:

Gold’s risk profile is elevated and may not suit all investors. Event headlines and geopolitics can drive abrupt two-way swings—use disciplined sizing and clear invalidation levels.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3965.00 | R1: 4334.00 |

| S2: 3798.00 | R2: 4540.00 |

| S3: 3592.00 | R3: 4705.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations