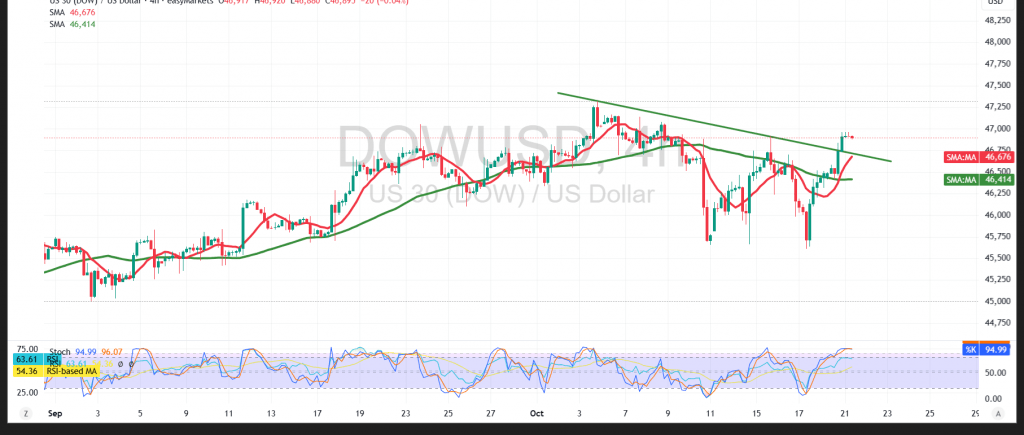

The Dow Jones Industrial Average on Wall Street achieved the bullish targets in the previous technical report, surpassing the official stop at 46,840 and recording a high of 46,963.

Technical Outlook for Today’s Session – 4-Hour Timeframe:

The 50-period simple moving average continues to provide a positive impetus, supporting continued upward attempts.

The Relative Strength Index (RSI): It is receiving positive signals in the short term, stable above the 50-period midline.

The Likely Scenario:

The bullish scenario may be the most favorable, noting that a confirmation of a breakout of 46,960 could extend the index’s gains to reach 47,110, an initial stop, which could later extend its gains to reach 47,160.

Conversely, a confirmation of a negative breakout of the 46,700 support level could put the index price under downward pressure towards 46,560.

Warning: Risk is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46560 | R1: 47110 |

| S2: 46215 | R2: 47310 |

| S3: 46015 | R3: 47650 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations