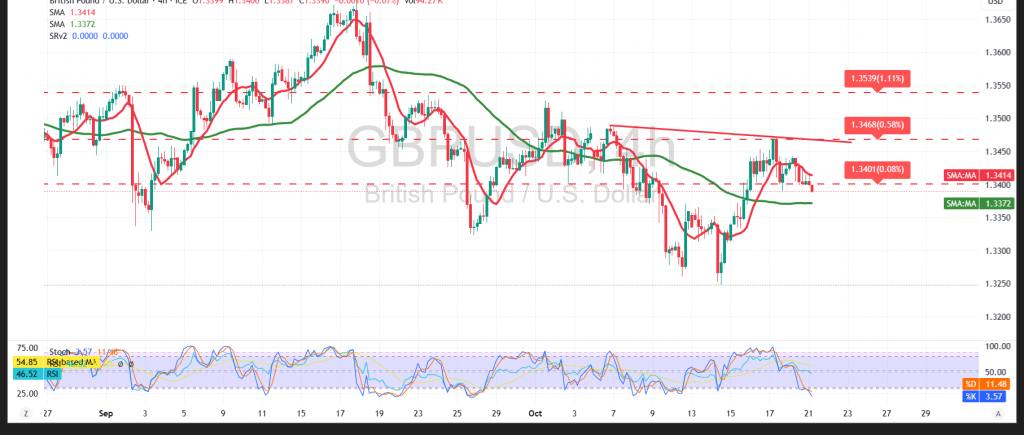

GBP/USD remains under bearish control after slipping through the 1.3400 pivot, trading near 1.3387 at the time of writing as sellers press the downside.

Technical:

The RSI has turned lower, confirming firm negative momentum on the 4-hour chart. Intraday stability below 1.3400 keeps the pressure skewed to the downside and limits rebound attempts.

Base case (downside continuation):

Bias stays lower while sub-1.3400. Price has scope to test 1.3360 (initial support); a break below 1.3360 would likely open 1.3330 next. (Correcting directionality from prior phrasing: continuation requires a break below support.)

Alternative (tactical rebound):

An hourly close above 1.3420 would temper the immediate bearish tone and could reopen 1.3475 on follow-through buying.

Risk:

Headline/geopolitical flows can trigger sharp two-way moves and an unfavorable risk-reward for some traders. Use disciplined sizing and clear invalidation levels.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3360 | R1: 1.3420 |

| S2: 1.3330 | R2: 1.3475 |

| S3: 1.3310 | R3: 1.3505 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations