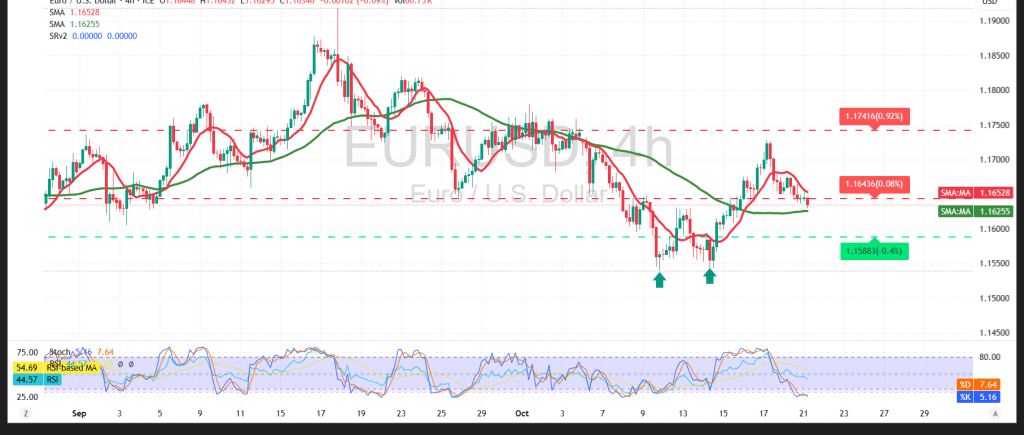

EUR/USD reversed the prior upside bias after failing to hold above 1.1640, slipping to an early-session low at 1.1632 and tilting the near-term tone lower.

Technical:

On the 4-hour chart, price is temporarily below 1.1640, skewing risk to the downside, though the 50-period SMA is still trying to prop price from below, hinting buyers could re-engage. RSI is nearing oversold, raising the prospect of positive divergence, while a double-bottom setup continues to argue for a corrective bounce if support holds.

Base case (recovery attempt):

Sustained holding above 1.1620 favors a rebound toward 1.1660; a break higher would open 1.1690, then 1.1720.

Alternative (downside extension):

An hourly close below 1.1600 would likely restore selling pressure and extend losses toward 1.1575.

Risk:

Trade/geopolitical headlines can trigger sharp two-way moves. Use disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1600 | R1: 1.1690 |

| S2: 1.1575 | R2: 1.1720 |

| S3: 1.1530 | R3: 1.1760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations