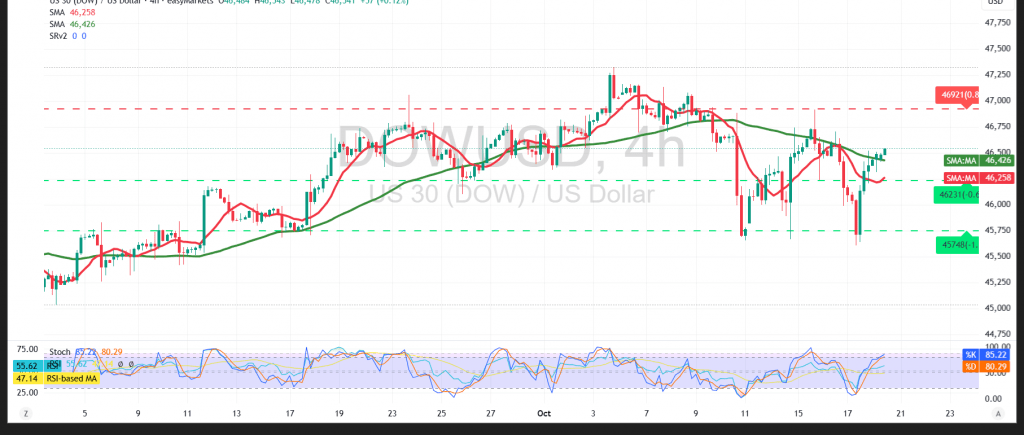

The Dow Jones Industrial Average is trading mixed with a positive tilt, as buyers probe higher levels following recent consolidation.

Technical:

Price is now above the 50-period SMA, which has flipped to dynamic support and aligns with a constructive short-term bias on the 4-hour chart. RSI has turned higher and is holding above the 50 midline, indicating improving momentum.

Base case:

If upside traction persists, the index may advance toward 46,700, with scope to extend to 46,840 on follow-through.

Alternative:

A decisive break below 46,100 would undermine the intraday bullish tone and expose 45,610 as the next downside objective.

Risk:

Given elevated geopolitical/trade headlines, swings can be abrupt and the risk-reward may be unfavorable for some investors. Use disciplined sizing and clear invalidation levels.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 45910 | R1: 46840 |

| S2: 45295 | R2: 47150 |

| S3: 44980 | R3: 47770 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations