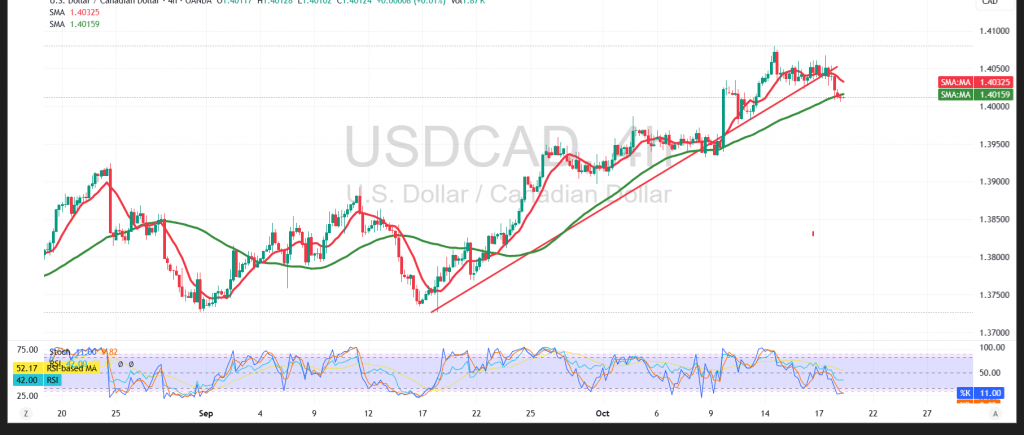

USD/CAD has flipped softer after several sessions of gains, with sellers probing for control in the near term.

Technical:

RSI has turned lower, signaling fading upside momentum. Price has also broken an ascending trend line, adding to negative pressure. Below, 1.4050 is acting as near-term resistance that caps rebounds.

Base case:

While below 1.4050, bias favors further downside. A clean break of 1.4000 would likely extend losses toward 1.3960, then 1.3930.

Alternative:

A decisive move above 1.4050 would temper the bearish tone and allow a retest of 1.4095.

Risk:

Trade/geopolitical headlines can drive sharp two-way swings. Use disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.4000 | R1: 1.4050 |

| S2: 1.3960 | R2: 1.4095 |

| S3: 1.3930 | R3: 1.4120 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations