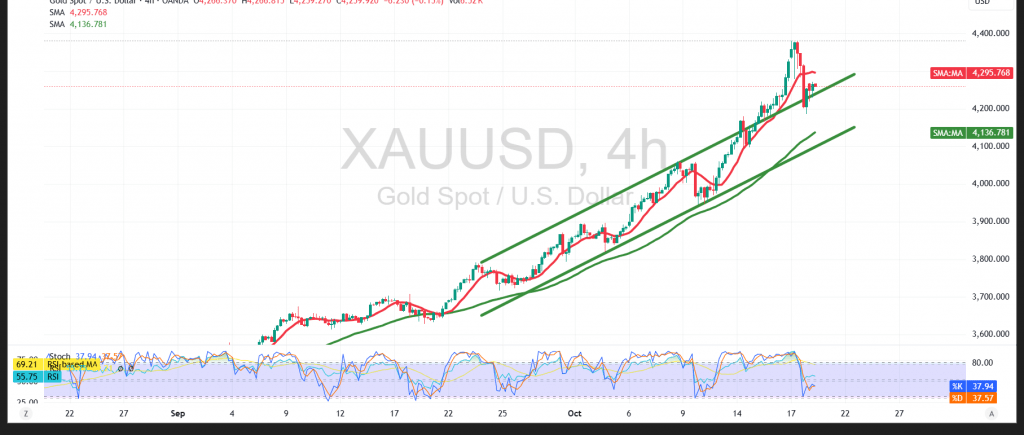

Gold (XAU/USD) swung sharply on Friday, spiking to $4,380 before retreating to a $4,185 low into the close. The tape remains choppy but underpinned by safe-haven demand.

Technical (4H):

Price is holding above $4,200, which has flipped into key support and provides a firm floor against deeper pullbacks. Up-sloping SMAs confirm intact bullish momentum, while the RSI has cooled from overbought without breaking trend—consistent with ongoing buyer control. That said, spot still sits beneath $4,280—a pivotal resistance that will likely dictate near-term direction.

Base case:

A decisive break and hourly close above $4,280 would likely resume the up-leg toward $4,350.

Alternative:

A clear, strong break below $4,200 would argue for a second corrective wave toward $4,173, then $4,080.

Risk:

Gold’s risk profile is elevated and may not suit all investors. Trade/geopolitical headlines can trigger abrupt two-way moves—use disciplined sizing and clear invalidation levels.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4173.00 | R1: 4370.00 |

| S2: 4080.00 | R2: 4470.00 |

| S3: 3980.00 | R3: 4560.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations