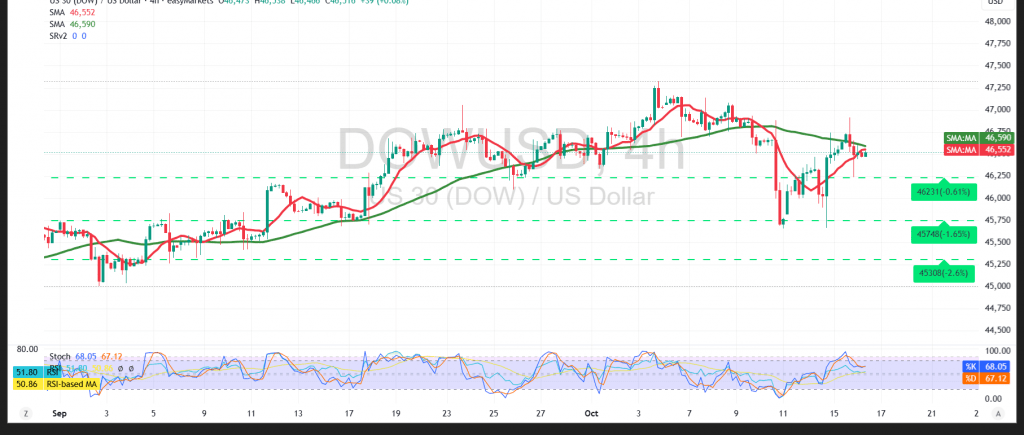

The Dow Jones Industrial Average is trading mixed with a modest positive tilt, as intraday flows test key resistance zones.

Technical:

Price is pressing the 50-period SMA near 46,590, attempting to turn it from resistance into support. RSI has started to firm with short-term positive signals, though it remains just below the 50 midline, keeping momentum tentative.

Base case:

A clean break above 46,560/46,590 would strengthen bullish traction and open 46,880 as the next upside objective.

Alternative:

A confirmed break below 46,200 would reassert downside pressure and expose 45,870.

Risk:

Event risk is high around upcoming remarks from the BoE Governor and the Fed Chair. Given elevated geopolitical/trade headlines, use disciplined sizing and clear invalidation levels; the risk-reward may not suit all investors.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46200 | R1: 46880 |

| S2: 45870 | R2: 47240 |

| S3: 45520 | R3: 47560 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations