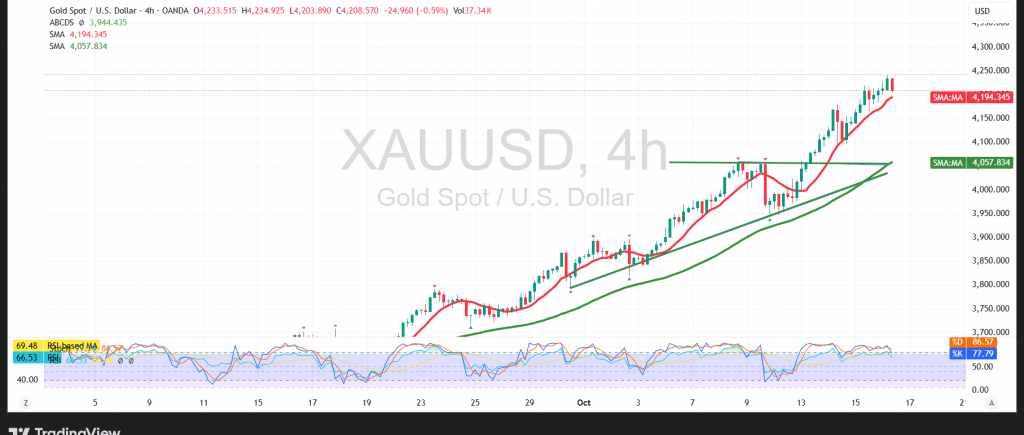

Gold (XAU/USD) extended its record-setting run in early trade, printing a new all-time high at $4,242/oz on firm safe-haven demand. Price action is holding above $4,155 and well above the $4,000 psychological pivot, confirming role-reversal support. Up-sloping simple moving averages keep bullish momentum intact, while RSI has cooled from overbought without a momentum breakdown—consistent with trend persistence rather than exhaustion.

Base case (bullish continuation):

- While above $4,155, bias stays positive.

- A clean break of $4,242 targets $4,256 initially, then $4,300.

Risk case (tactical pullback):

- A decisive move below $4,155 signals corrective pressure toward the $4,000 area before dip-buyers likely re-engage.

Risk management:

Volatility is high and may not suit all investors. Use disciplined sizing, clear invalidation levels, and avoid over-exposure around event headlines.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4155.00 | R1: 4256.00 |

| S2: 4096.00 | R2: 4300.00 |

| S3: 4052.00 | R3: 4360.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations