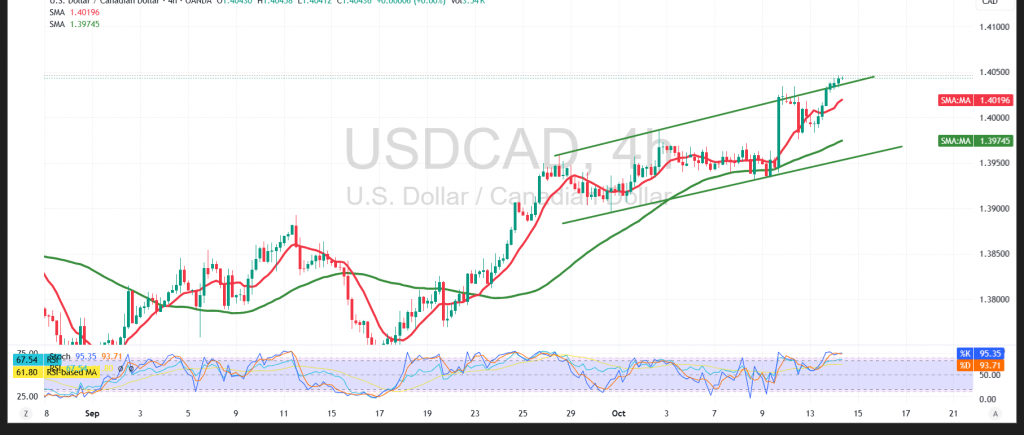

The pair continues its gradual advance in line with our positive bias, edging toward the prior target after printing a session high at 1.4046.

Technical Overview

- Momentum: The RSI maintains constructive short-term signals, consistent with ongoing bullish momentum.

- Trend filter: Price action remains above the 50-period SMA, reinforcing the prevailing uptrend and limiting the depth of pullbacks.

Probable Scenario

Holding above 1.4000—the former resistance now turned support—keeps the bullish outlook intact. Immediate resistance is seen at 1.4065, with scope for an extension toward 1.4095 if buying pressure persists.

A decisive break below 1.4000 would dent the near-term bias and expose a retest of 1.3960.

Caution

Heightened volatility is possible around the upcoming speeches by the Bank of England Governor and the U.S. Federal Reserve Chair. Risk remains elevated amid trade and geopolitical tensions, so disciplined risk management is advised.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.4000 | R1: 1.4060 |

| S2: 1.3960 | R2: 1.4095 |

| S3: 1.3930 | R3: 1.4130 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations