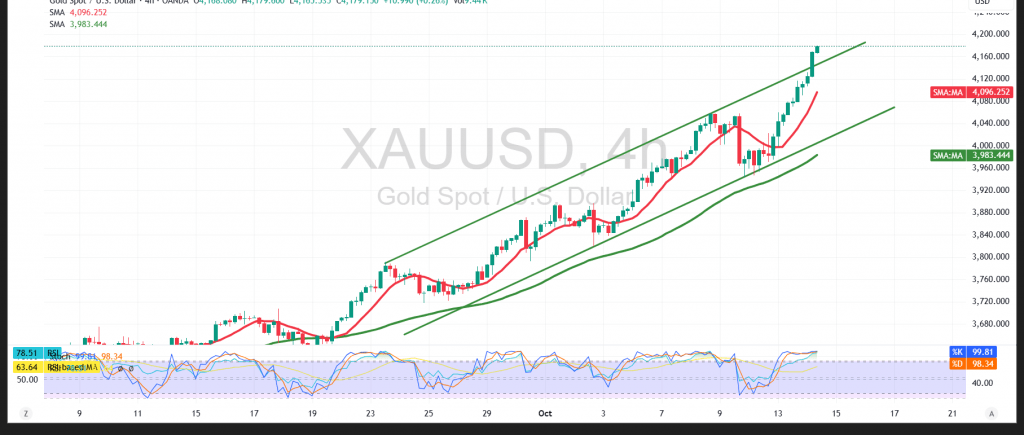

Gold prices continue to post sharp consecutive gains, extending the strong bullish trend and marking a new record high at $4,180 per ounce at the time of writing. The move is supported by increased demand for safe-haven assets amid persistent market uncertainty.

Technical Overview

The price has successfully stabilized above the key psychological level of $4,000, which now serves as a major support zone according to the principle of role reversal between support and resistance.

Meanwhile, the simple moving averages (SMAs) continue to slope upward, confirming the strength of bullish momentum and reinforcing expectations for further gains in the medium term.

However, early signs of weakness are emerging on the Relative Strength Index (RSI) after entering overbought territory, suggesting the potential for short-term profit-taking or a temporary corrective pullback before the broader uptrend resumes.

Likely Scenario

As long as trading remains above $4,115, the bullish trend is expected to continue.

A short-term correction toward the $4,137–$4,115 range could serve to refresh positive momentum, paving the way for a potential move toward $4,200, a key psychological resistance level.

On the other hand, a decisive break below $4,000 could shift the short-term technical outlook and open the door for a deeper corrective move before the uptrend resumes.

Caution

Risk levels remain elevated, especially ahead of upcoming speeches by the Bank of England Governor and the U.S. Federal Reserve Chair, which could trigger sharp volatility across financial markets.

Traders are advised to maintain disciplined risk management, as ongoing trade and geopolitical tensions keep all scenarios on the table.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4055.00 | R1: 4228.00 |

| S2: 3940.00 | R2: 4286.00 |

| S3: 3882.00 | R3: 4401.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations