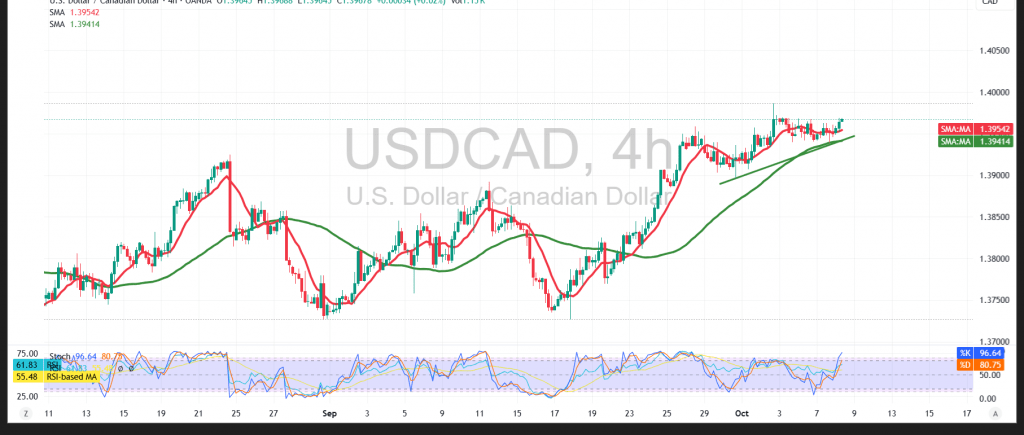

The USD/CAD pair extended its upward movement for a second consecutive session, maintaining positive momentum in line with the previously expected bullish outlook. The pair continues to benefit from sustained demand for the US dollar and firm technical support.

Technical Outlook – 4-Hour Timeframe:

The Relative Strength Index (RSI) continues to issue positive short-term signals, confirming renewed buying interest and reinforcing the likelihood of continued upward momentum.

Meanwhile, the 50-day Simple Moving Average (SMA) remains positioned below current price levels, acting as dynamic support and validating the ongoing bullish bias.

Probable Scenario:

As long as the pair holds above the previously breached resistance—now turned support—at 1.3920, the bullish scenario remains favored. A confirmed breakout above 1.3950 could strengthen upward momentum, paving the way for the next targets at 1.3990 and potentially 1.4020.

Conversely, a break below 1.3920 would expose the pair to renewed downside pressure, likely prompting a retest of the 1.3880 support area before buyers attempt to regain control.

Warning:

Volatility risks remain elevated amid persistent trade and geopolitical tensions. Market conditions may shift abruptly, and all scenarios remain possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 1.3940 | R1: 1.3990 |

| S2: 1.3905 | R2: 1.4020 |

| S3: 1.3880 | R3: 1.4050 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations