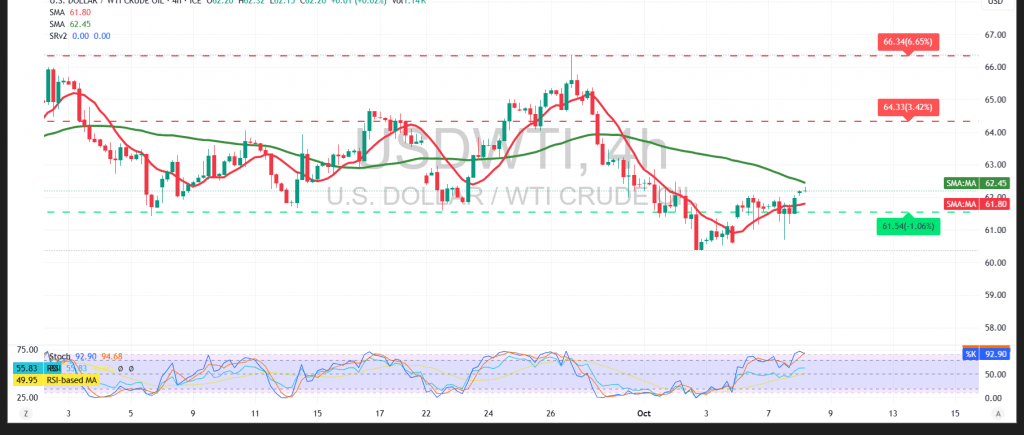

US WTI crude oil futures resumed an upward trajectory, attempting to recover losses from prior sessions after successfully establishing a solid support base near $60.80 per barrel. The move reflects renewed buying interest following a period of corrective pressure.

Technical Outlook – 4-Hour Timeframe:

The price is currently testing the $61.50 resistance level, attempting to consolidate above it. This level has now shifted into short-term support, bolstered by improving momentum signals from the Relative Strength Index (RSI), which indicates strengthening bullish sentiment.

However, the 50-day Simple Moving Average (SMA) continues to act as dynamic resistance, potentially capping further upside momentum in the near term unless a clear breakout occurs.

Probable Scenario:

Sustained intraday stability above the recently breached $61.40 level could encourage buyers to push prices higher toward $62.75, with a potential extension to $63.30 if bullish momentum strengthens.

Conversely, a break below the $61.20 support zone may quickly halt upward attempts and reintroduce selling pressure, exposing the market to a retest of $60.20.

Warning:

Volatility risks remain elevated amid ongoing trade and geopolitical tensions. Market conditions may shift rapidly, and all scenarios remain possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 61.20 | R1: 62.75 |

| S2: 60.20 | R2: 63.35 |

| S3: 59.70 | R3: 64.35 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations