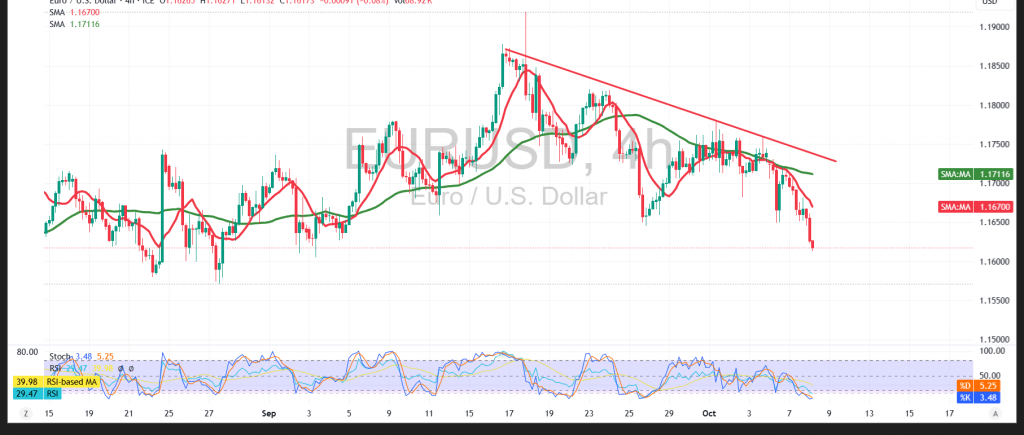

The EUR/USD pair extended its bearish trajectory in line with previous expectations, reaching the first downside target at 1.1645 and recording a new session low of 1.1619 during early trading.

Technical Outlook – 4-hour timeframe:

The broader trend remains decisively bearish, with the pair consistently trading below the 50-day Simple Moving Average (SMA), which continues to act as dynamic resistance and sustain downward pressure. The 1.1650 level, previously a support, has now turned into a key resistance point, adding to the prevailing selling bias.

Furthermore, price action continues to move along a well-defined descending trend line, confirming the dominance of bearish momentum over the short term.

Most Probable Technical Scenario:

As long as the pair remains below 1.1650 — and more importantly, below 1.1680 — the negative outlook is expected to prevail. A confirmed break below 1.1585 would reinforce the bearish trend, opening the path toward the next support levels at 1.1555 and potentially 1.1500.

Conversely, a decisive move above 1.1680 could trigger a short-term corrective rebound, targeting 1.1745 initially, with a possible extension to 1.1775 if momentum strengthens.

Warning:

Market risk remains elevated amid persistent trade tensions and geopolitical uncertainty. Traders should exercise caution, as volatility could increase sharply, and all scenarios remain possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1585 | R1: 1.1680 |

| S2: 1.1555 | R2: 1.1745 |

| S3: 1.1495 | R3: 1.1775 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations