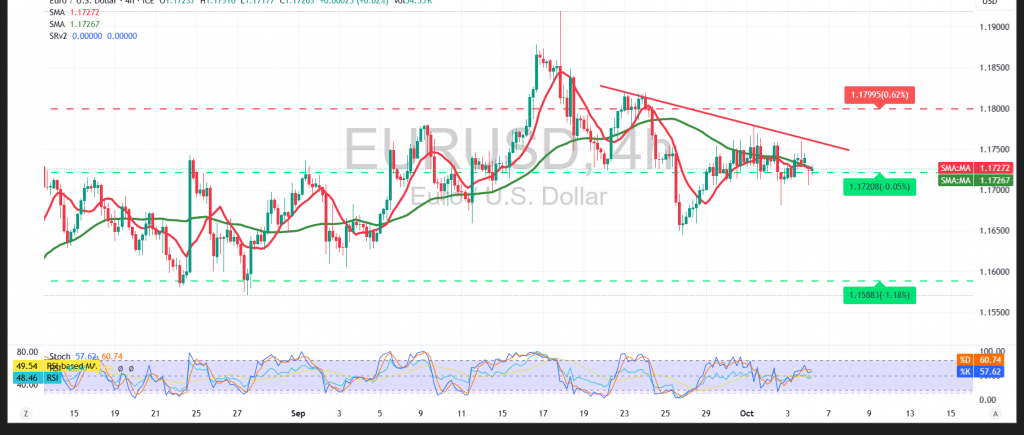

The pair maintains its expected downward trajectory, having repeatedly failed to break the 1.1760 resistance level over several consecutive sessions.

Technical Picture:

- 50-Day Simple Moving Average (SMA): The pair continues to trade below this level, which acts as dynamic resistance, limiting any further upside attempts.

- Relative Strength Index (RSI): Recently entered the overbought zone relative to the price action, suggesting the potential for negative divergence and renewed downside pressure.

- Trend Structure: Price action remains confined within a descending trend line, confirming the continued dominance of the bearish bias.

Probable Scenario:

- Bearish Case (preferred): Stability below 1.1760 maintains the negative outlook. A confirmed break below 1.1690 may open the way toward 1.1645, followed by 1.1605 as the next support levels.

- Bullish Case (alternative): A break above 1.1765 and sustained trading above it could revive recovery attempts toward 1.1800, with potential extensions to 1.1835.

Warning: The risk level remains high amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1700 | R1: 1.1755 |

| S2: 1.1675 | R2: 1.1785 |

| S3: 1.1645 | R3: 1.1810 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations