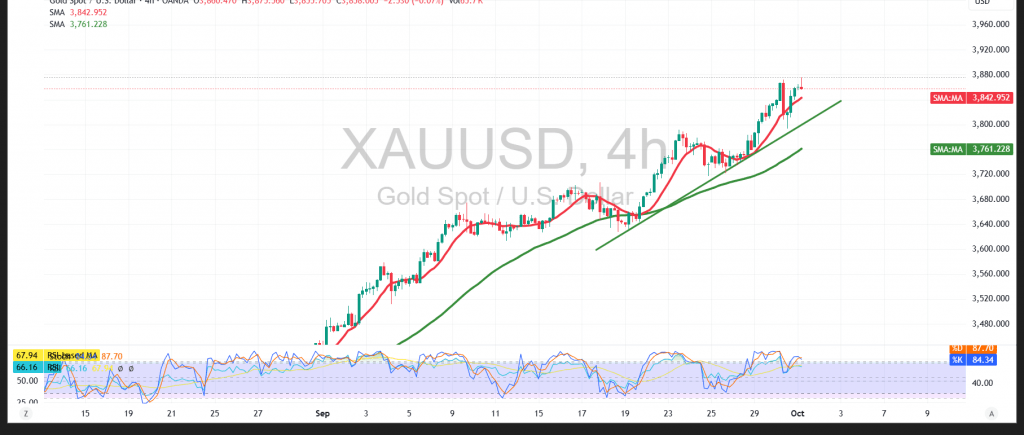

Gold successfully completed the corrective decline highlighted in the previous report, reaching $3,793, before resuming its upward trajectory and recording a new session high at $3,875 in early trading today.

Technical Outlook:

- Trend: The overall bias remains bullish after the completion of the initial correction wave.

- 50-period SMA: Price continues to trade above the moving average, reinforcing the uptrend as dynamic support.

- RSI: The indicator has cleared overbought conditions and is regaining positive momentum, suggesting renewed buyer control.

Probable Scenario:

- Bullish Case: A confirmed breakout above $3,875 strengthens the upward bias, opening the way to $3,891 and then the psychological barrier at $3,900.

- Bearish Case: Failure to surpass $3,875 could trigger another corrective wave, targeting $3,843 and then $3,810, before buyers attempt to reassert control.

Risk Warning: The risk level remains high and may not be proportional to the potential reward. Heightened volatility is expected today with the release of ADP non-farm employment change.

Note: Trade and geopolitical tensions continue to amplify uncertainty, keeping all scenarios possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3810.00 | R1: 3891.00 |

| S2: 3760.00 | R2: 3924.00 |

| S3: 3727.00 | R3: 3973.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations