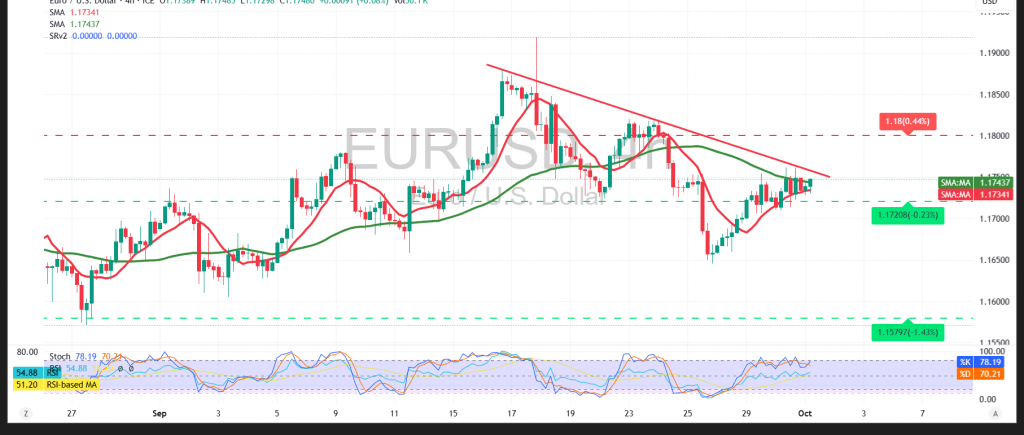

The pair continues to trade in a narrow sideways range with a cautious upward bias.

Technical Outlook:

- 50-day Simple Moving Average (SMA): Price remains capped below this level, reducing the probability of sustained upside movement.

- Relative Strength Index (RSI): Now in overbought territory, signaling weakening momentum and the potential for downside pressure.

- Trendline: Ongoing movement along a descending trend line highlights the continued dominance of the broader bearish trend.

Probable Scenario:

- Bearish Case: Stability below 1.1760 keeps the negative outlook intact. A break of 1.1690 could extend declines toward 1.1665, with scope for further downside to 1.1640.

- Bullish Case: A breakout above 1.1765 with firm consolidation may trigger additional gains toward 1.1790, with the potential to extend to 1.1820.

Note: Markets are awaiting key US economic data today, ADP non-farm employment change and ISM Manufacturing PMI), both of which may drive heightened volatility.

Risk Warning: Risk remains elevated amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1720 | R1: 1.1765 |

| S2: 1.1690 | R2: 1.1790 |

| S3: 1.1665 | R3: 1.1820 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations