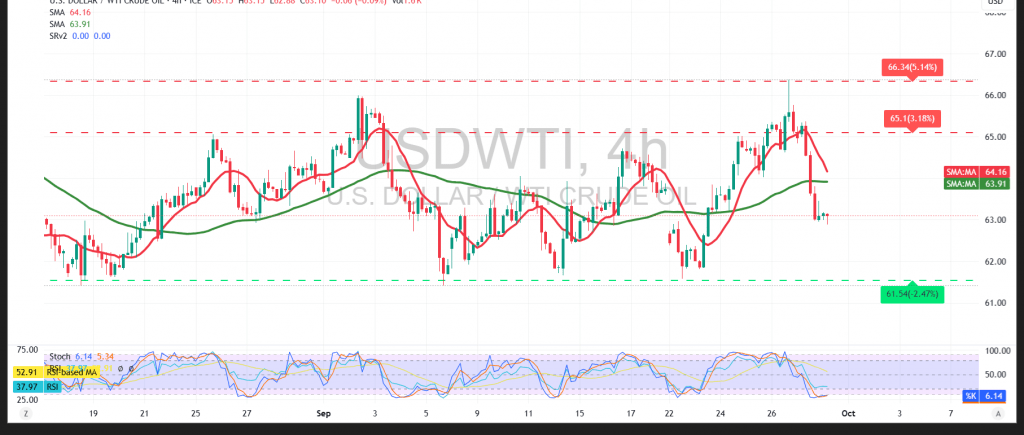

US crude oil futures (WTI) continue their decline, hitting a key resistance level around 65.30, which successfully limited the rise.

Technical Outlook – 4-hour timeframe:

Simple moving averages: Pressuring prices from above, forming dynamic resistance that limits any upward rebound.

Relative Strength Index (RSI): Around oversold areas, with positive signs beginning to emerge, but the presence of a downward sub-wave within a steep downtrend may reduce recovery chances.

Current resistance: 64.35, while stability below 64.60 remains evidence of the strength of the downtrend.

A break of the 62.90 support level will increase selling pressure and open the way to 62.20 as a potential immediate target, with a potential extension to 61.50 later.

On the other hand, a break of the 64.60 resistance level with an hourly close above it may give oil a chance for a temporary recovery towards 66.20.

Warning: Today, we are awaiting high-impact economic data from the US economy, including job openings and labor turnover. We may experience significant price volatility when the news is released.

Warning: Risk is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 62.20 | R1: 64.65 |

| S2: 61.40 | R2: 66.20 |

| S3: 59.80 | R3: 67.05 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations