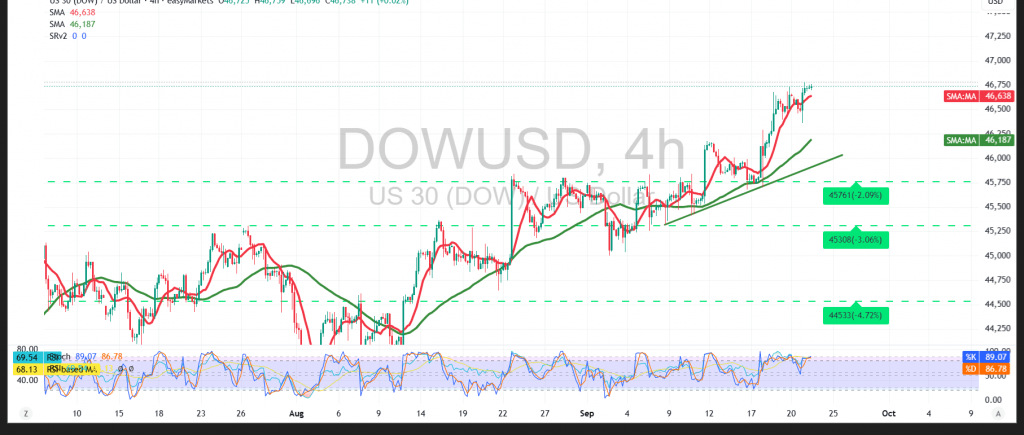

The index succeeded in achieving the first bullish target outlined in the previous report at 46,635, recording a session high of 46,784.

Technical Outlook:

- 50-period Simple Moving Average (SMA): Continues to support the price from below, acting as dynamic support and reinforcing the bullish outlook.

- Relative Strength Index (RSI): Showing positive signs on short-term timeframes, suggesting scope for additional upward momentum.

Probable Scenario:

- Bullish Case: Consolidation above 46,560 maintains the upward trajectory, targeting 46,830 first, with potential to extend towards 46,890.

- Bearish Case: A confirmed return below 46,560 could trigger renewed downside pressure, with the index likely to retest 46,470.

Note: Markets await high-impact US economic data today (Services and Manufacturing PMI), which may fuel strong volatility.

Risk Warning: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves risks, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 46470 | R1: 46890 |

| S2: 46205 | R2: 47050 |

| S3: 46050 | R3: 47310 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations