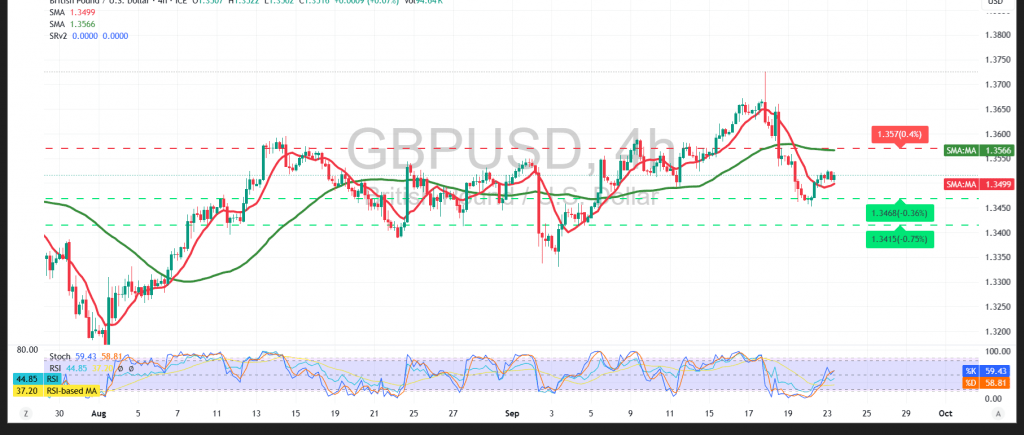

The pair witnessed mixed trading with a slight bullish bias after establishing a short-term support line.

Technical Outlook:

- Relative Strength Index (RSI): Showing negative signals due to overbought conditions relative to price action, raising the risk of negative divergence.

- 50-Period Simple Moving Average (SMA): Acting as dynamic resistance, maintaining downward pressure on the pair.

Probable Scenario:

- Bearish Case: The 1.3530 level, and more importantly 1.3540, remain the pivot for downside control. Holding below these levels favors a continuation of the bearish bias, with downside targets at 1.3470 and 1.3420.

- Bullish Case: A clear breakout above 1.3540 could restore buyers’ control, opening the way to 1.3570 first, with gains potentially extending toward 1.3600.

Warning: Markets are awaiting high-impact US data today (Services and Manufacturing PMI). Significant volatility is expected upon release.

Risk Note: Risk remains high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3470 | R1: 1.3540 |

| S2: 1.3420 | R2: 1.3570 |

| S3: 1.3390 | R3: 1.3615 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations