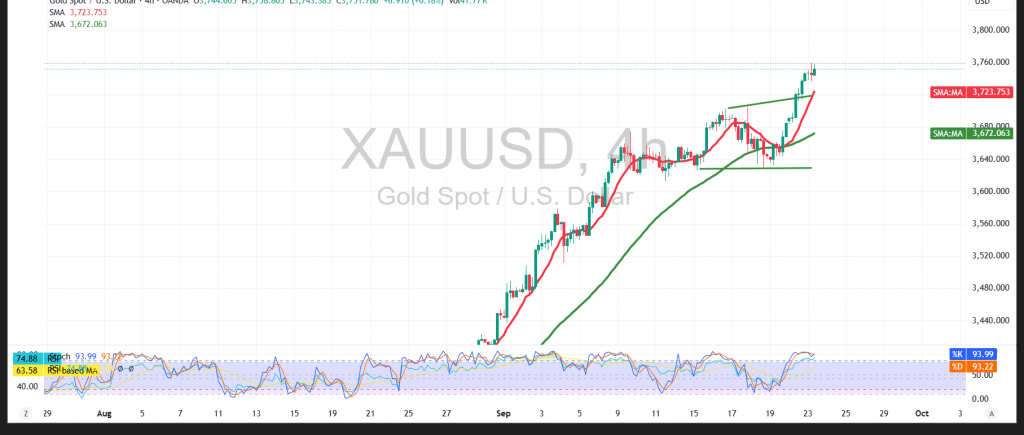

Gold extended its rally during the European session, recording a high of $3,759 per ounce, surpassing the previously mentioned $3,720 resistance.

Technical Outlook:

- Simple Moving Averages (SMA): Price action remains supported above the moving averages, which act as dynamic support reinforcing the bullish structure.

- Relative Strength Index (RSI): Approaching overbought territory, suggesting the potential for a short-term correction before the broader upward trend resumes.

Probable Scenario:

- Bearish Case: A retest of $3,725 may occur, and a clear downside break below this level could trigger a deeper correction toward $3,700.

- Bullish Case: A confirmed breakout above the recent high at $3,759 could add momentum, targeting $3,777 first, followed by $3,806.

Warning: Markets are awaiting high-impact US data releases today, including the Services and Manufacturing PMI. Volatility is expected when the figures are published.

Risk Note: Risk remains elevated amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3701.00 | R1: 3777.00 |

| S2: 3654.00 | R2: 3806.00 |

| S3: 3625.00 | R3: 3853.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations