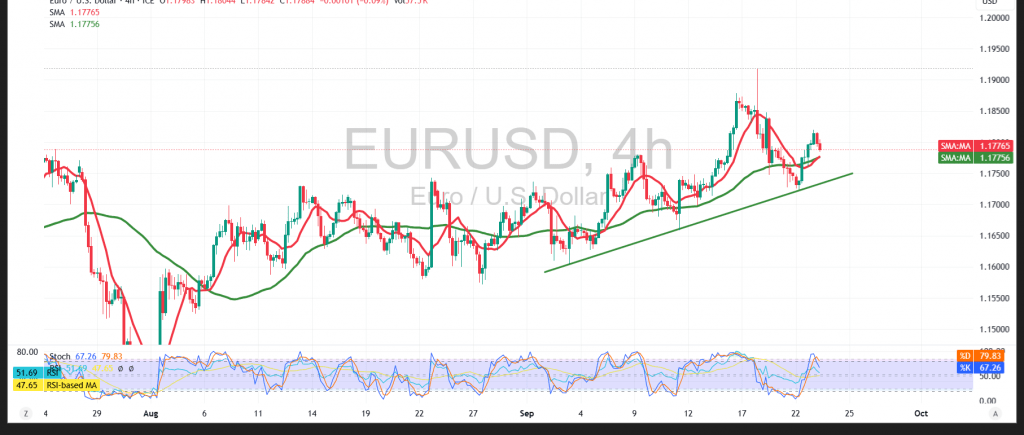

The pair temporarily reversed the expected outlook from the previous report. While we anticipated stability below 1.1770, a breakout above this resistance and consolidation pushed the price to 1.1819.

Technical Outlook:

- 50-Day Simple Moving Average (SMA): Continues to provide dynamic support, maintaining the overall bullish structure.

- Relative Strength Index (RSI): Approaching overbought territory, signaling potential for a short-term corrective pullback before buyers regain control.

Possible Scenario:

- Bearish Case: A pullback below the role-reversal support at 1.1770 could place the pair under temporary negative pressure, paving the way for a retest of 1.1700–1.1690.

- Bullish Case: A breakout above 1.1820 and stability above it may extend recovery attempts, targeting 1.1840 first, with potential gains stretching toward 1.1875.

Warning: Markets are awaiting high-impact US economic data today (Services and Manufacturing PMI releases). Volatility is expected to increase upon release.

Risk Note: The risk level remains high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1745 | R1: 1.1840 |

| S2: 1.1690 | R2: 1.1875 |

| S3: 1.1650 | R3: 1.1930 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations