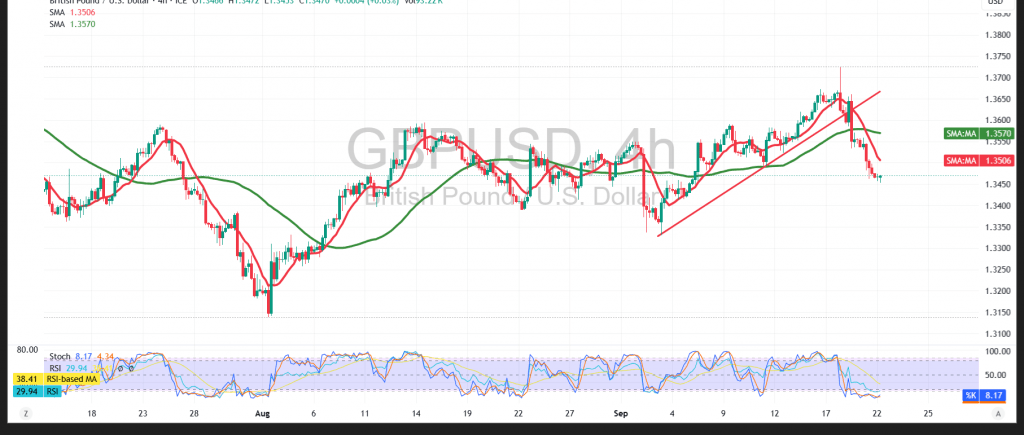

The pair opened the week under pressure after touching the 1.3560 resistance level, which triggered a wave of negative trading.

Technical Outlook:

- Relative Strength Index (RSI): The indicator is beginning to show early positive signs, likely reflecting temporary relief from oversold conditions, which may briefly limit additional downside pressure.

- 50-period Simple Moving Average (SMA): Continues to act as dynamic resistance, pressing the price from above and reinforcing the bearish bias.

Probable Scenario:

The 1.3510 level, and more importantly 1.3530, represent the key thresholds for today’s trading. As long as the pair remains below these levels, the bearish outlook dominates, with 1.3425 as the initial downside target. Conversely, a confirmed break above 1.3530 could restore bullish momentum and open the way toward 1.3600.

Warning: Risk is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3425 | R1: 1.3535 |

| S2: 1.3380 | R2: 1.3600 |

| S3: 1.3320 | R3: 1.3640 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations